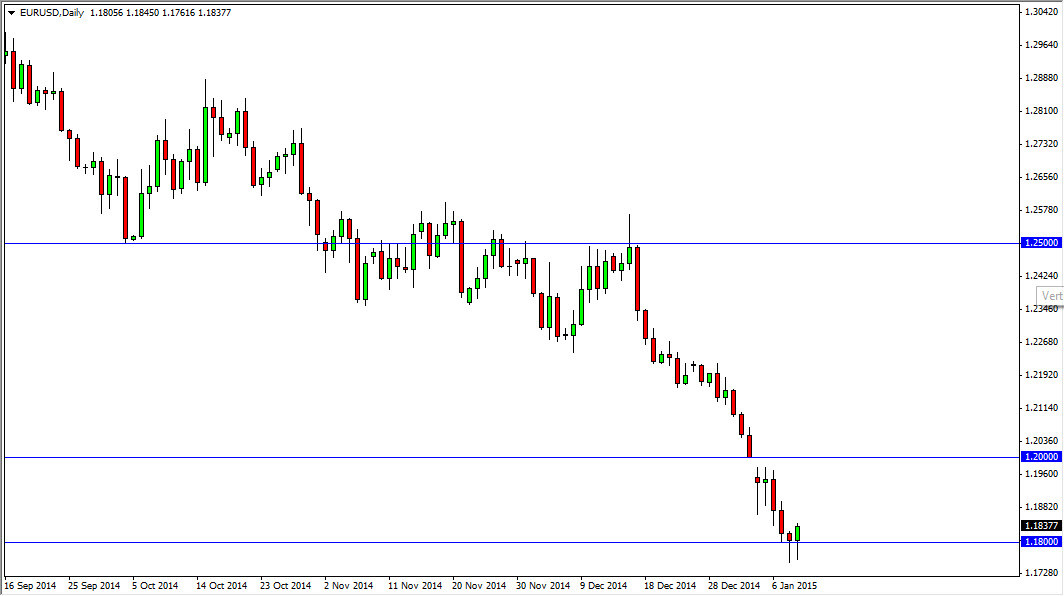

The EUR/USD pair initially broke down below the all-important 1.18 level during the session on Friday, and tested fairly low numbers. However, we did have seen enough of a bounce by the end of the session to turn things around and form a hammer. This is the second hammer in a row and it is at a vital support level. This support level is important on the monthly timeframe to as well, so quite frankly it doesn’t get much bigger than this. Because of that, I’m very interested in this market all of a sudden.

It’s been easy to sell this market over and over as time has gone by, but at this point time I think we are reaching we could eventually end up being the bottom of the massive downtrend. If we can break above the 1.20 level, I think this market really could pick up to the upside. However, expect a lot of volatility in this general vicinity, but in the short-term it would not surprise me at all to see this market try to go back and fill the gap at the 1.20 handle, which is a fairly common technical analysis move.

Dual hammers almost always means something

It’s pretty rare that you see two hammers in a row that don’t actually mean something. Because of this, I think we are going to spend the next couple of weeks grinding away between the 1.18 level and the 1.20 level. Ultimately though, the market will make up its mind. It would not surprise me at all to see the January monthly candle end up forming a hammer. If we do, at that point in time I think the downtrend is over.

There are already people in the Federal Reserve talking about not raising rates during 2015, and I believe that a lot of this move is based upon expectation of rates being raised in America this year. As soon as he gets out that the Federal Reserve probably won’t do that, this pair is going to shoot through the sky. On the other hand, if we break down below the bottom of the hammer on Thursday, that would be horribly negative sign.