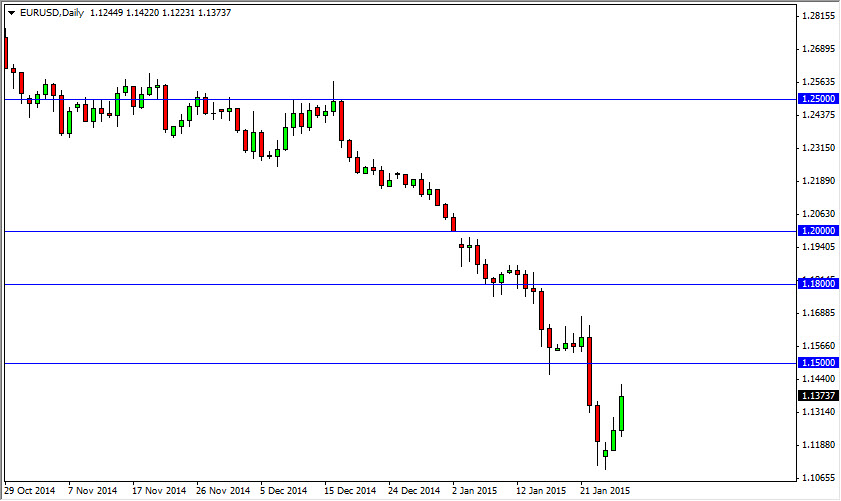

The EUR/USD pair broke higher during the course of the session on Tuesday, testing the 1.14 level. However, we think that the real resistance is up to the 1.15 handle, and as a result we believe that the market will continue to go slightly higher initially, but should see quite a bit of resistance at that point. That should be an area where we had seen previous support that had been broken down after the extended quantitative easing announcement that we had last week. With that being the case, I feel that the EUR/USD pair will continue to sell off the further we go forward, perhaps heading to the 1.10 level.

Ultimately, the market looks as if it should continue to be volatile, based upon the fact that during the Tuesday session we had the Core Durable Goods Orders come out softer than anticipated in the United States. They get a little bit of hope for the Euro, but let’s be honest: this is a very important day.

Major announcement today

The FOMC announcement comes the day, and although we do not anticipate seeing any type of interest-rate cut or hike, there will be a question-and-answer session afterwards. This will be parsed by the markets to see where the Federal Reserve may go next. That of course will have a bit of an influence on the US dollar overall. That of course will show itself. And as a result we could get a little bit of volatility. However, I believe that there is a downtrend for a reason, and with that being the case any rally at this point time is essentially value in the US dollars far as I can see. In fact, I do not believe that the trend can be questioned until we get above the 1.20 handle.

Resistive candles above should continue to offer selling opportunities, and I will keep my eyes open for those particular setups. If we find some type of resistant candle at the 1.15 level, I would even sell off of the shorter-term charts as it is with the trend.