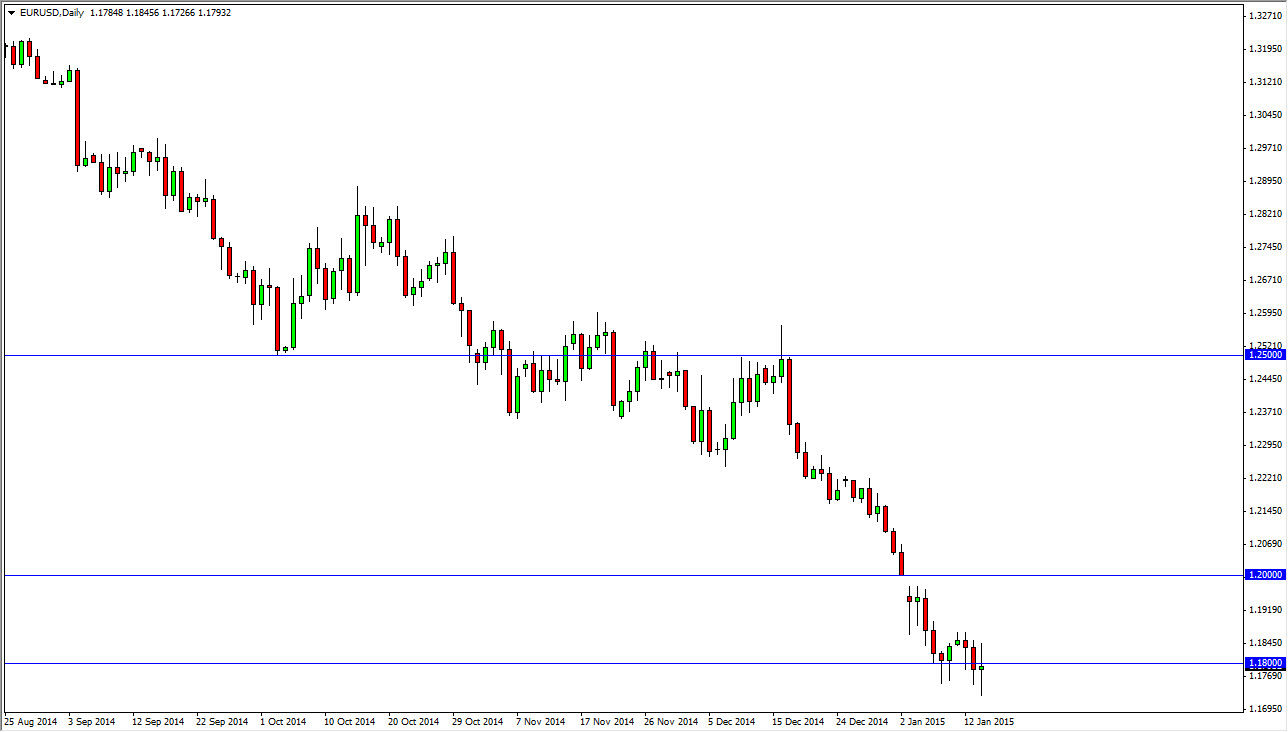

The EUR/USD pair continues to stagnate as we see the 1.18 level as been a bit of a magnet for price. Because of this, I don’t really have a whole lot that I want to do with this pair, at least not right now. However, there are some longer-term implications of where we are, and what happens next. This is probably the wrong market to be involved in from the short-term at this point in time because the 1.18 level is so supportive. Quite frankly, this is an area that people will struggle at simply because it is the possible beginning of a trend change. The reason I say that is that the 1.18 level has been supportive for 10 years. If we break down below it, this will be catastrophic for the Euro, but more than likely we will see a bounce from here. It won’t be clean, and it won’t be easy, but it should happen.

Having said that…

Having said that it should happen doesn’t mean that it will. Because of this, I have to keep an open mind and recognize that we could in fact break down from here. We certainly are not getting any real traction to the upside, so this could essentially be a bit of a rest before the next push lower. I think that the Euro is oversold at this point though, so the very least a bounce is probably going to be needed in order to break this pair down.

If we do get that bounce, I think that we will head to the 1.20 level. There’s a nice gap there that hasn’t been filled, and of course that is one of the basic tenets of technical analysis. If we get above the 1.20 level, I still think that we go to the 1.2350 handle, but we shouldn’t get too far ahead of ourselves at this point. Ultimately, this is probably a pair that you should observe and not trade at the moment as we begin to ask serious questions.