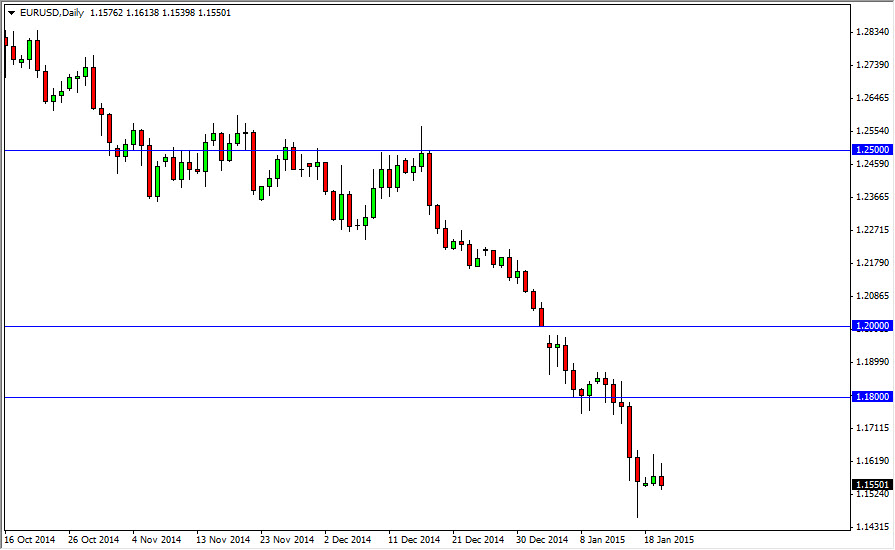

The EUR/USD pair tried to break higher during the course of the session on Tuesday again, but just like Monday, we ended up seen enough selling to turn things back around and form a shooting star. The shooting star is the second shooting star in a row, which of course shows extreme weakness. The only reason I am not selling this pair right away is that we are sitting just above the 1.15 handle, which of course is a large, round, psychologically significant number. On top of that, we also have the hammer that has not been broken below from last week. So having said that, if we break down below the lows of last week, I believe that the market will then grind all the way down to the 1.10 handle.

If we can break the top of the two shooting stars, this market could very easily break out to the upside and head towards the 1.18 handle. That level of course was supportive in the past, but ultimately should offer resistance now as it is basic technical analysis. It has not been retested yet, so it would make quite a bit of sense if we did bounce towards that direction.

The Euro continues to struggle overall

The Euro continues to struggle overall, and we have seen losses in the Euro against pretty much everything out there during the session on Tuesday. Because of this, I do feel that we eventually break down but I also recognize that the market is extraordinarily oversold at this point. As Forex is a leveraged market, you have to be very careful with these moves, because if you enter at the wrong time you could find yourself 200 pips in the wrong direction.

Having said that though, I have no interest whatsoever in buying this market until we get above the 1.20 handle, which in my opinion could even suggest that the trend could possibly be changing. I do not see that happening anytime soon though, as the downtrend is so strong and the Euro has so many issues.