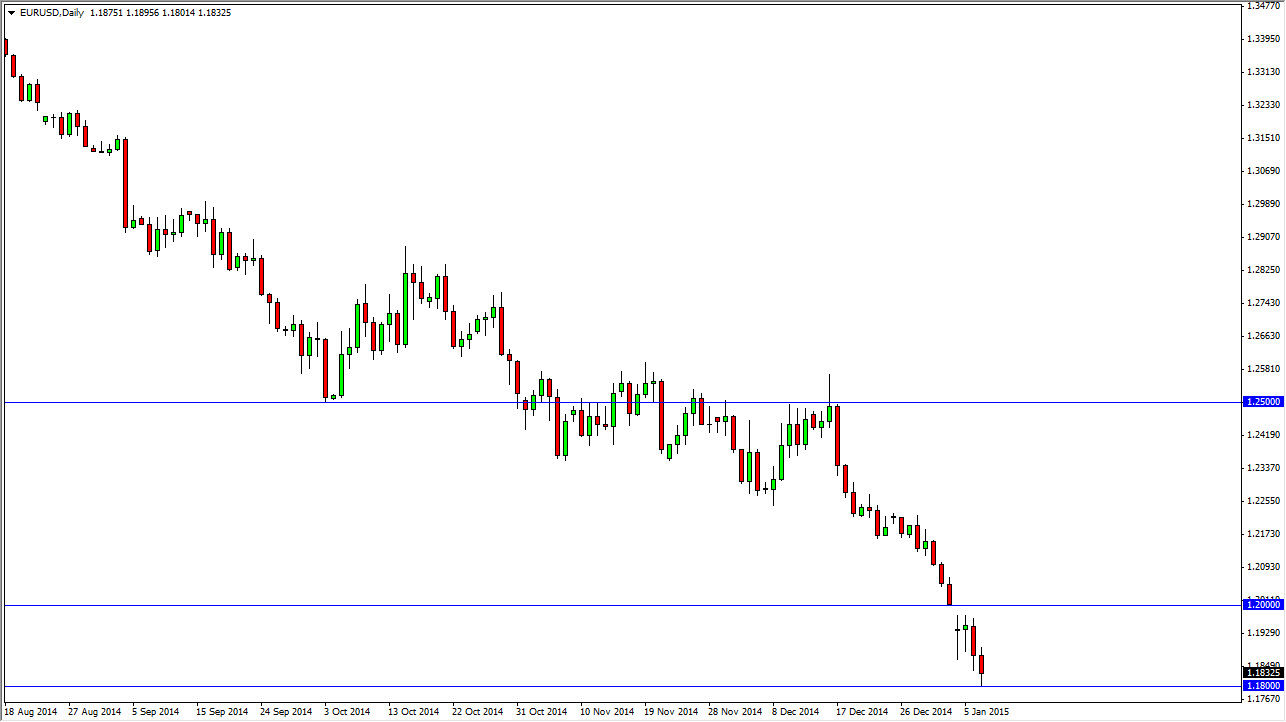

The EUR/USD pair fell during the majority the session on Wednesday, touching the 1.18 level. This is a very important levels far as I can see, as it looks to be supportive on the monthly charts. Support on a monthly charts certainly is something that you have to pay attention to, and as a result I’m actually looking for a buying opportunity. I don’t necessarily know that we will get it, but at the trend is going to change, this is a perfect spot to do it.

I believe that a lot of this will be determined by the nonfarm payroll numbers coming out on Friday, so with that being said, the next day or two may be kind quiet, waiting for the announcement. If the announcement is a complete blowout and the United States looks very strong, it’s very possible at that point time we may make a move below the 1.18 handle. A daily close below that level sends this market looking for 1.10 in my opinion. Having said that though, it’s hard to believe that might actually be the case. I cannot tell you how many times I’ve written off the euro only to be proven wrong.

Daily or above candles only

I have no interest in trading this chart off of anything below the daily timeframe. I believe that if we get a signal, it’s going to be a longer-term one. I don’t know that is going to be up or down yet, but I am suspecting at this point in time that the upside is probably the real risk. After all, people have been selling the Euro off hand over fist for months. On the other hand, I am very hesitant to go against the trend so I need to see the perfect candles. If I don’t get that, a move back above the 1.20 level is probably enough for me to start buying again. On the other hand, if we do get that break down below the 1.18 level, I am going to continue to sell rallies every time they appear for the foreseeable future.