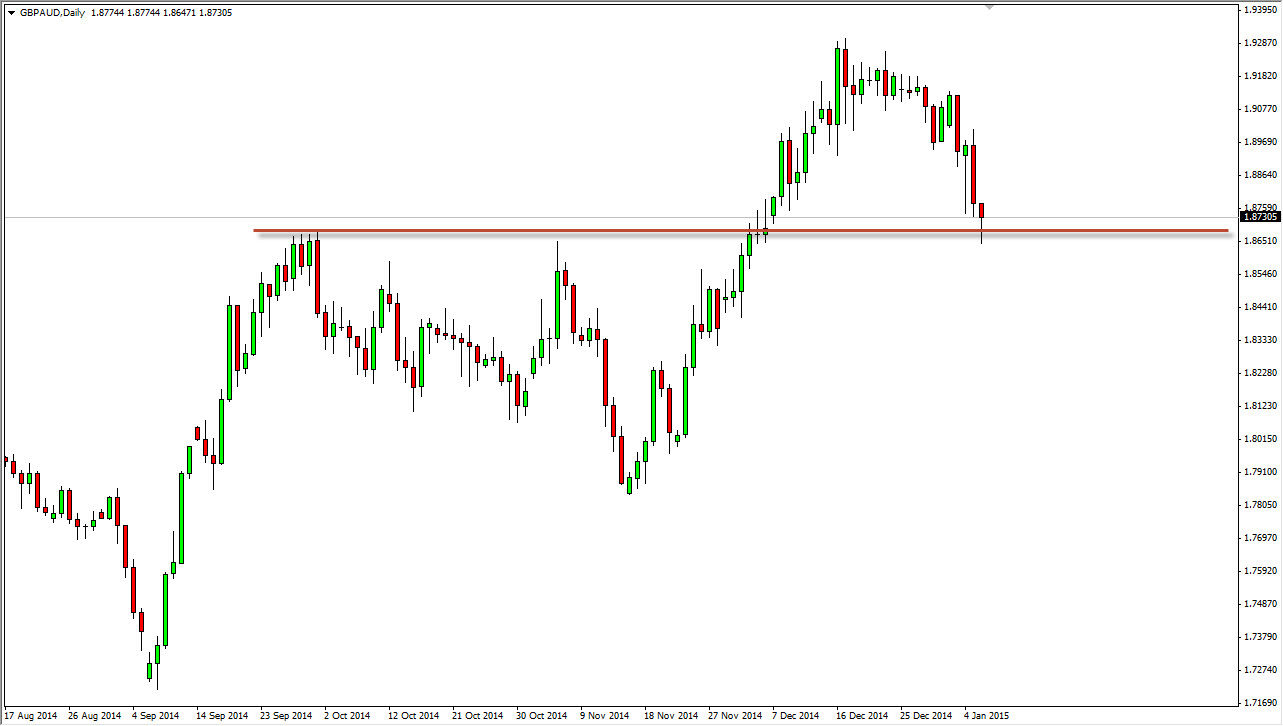

The GBP/AUD pair initially fell during the course of the day on Tuesday, but as you can see bounced enough to form a nice-looking hammer. That hammer of course is suggestive of buying pressure, and a break above the top of the hammer is a classic technical analysis signal to start buying. With that, I would anticipate that we would move to the 1.90 level, and then ultimately to the 1.93 level. On top of that, the hammer form that the 38.2% Fibonacci retracement level, and a place where there had previously been resistance back in the month of September. In other words, it makes a lot of sense to see support come back into the marketplace and that a hammer would form year.

Because of that, I believe that a break above the top of the hammer is a very good buying opportunity, and I am not interested in selling this pair at the moment. Yes, I recognize of the British pound is a bit soft against the US dollar, but not nearly soft as the Australian dollar is. In other words, the pound isn’t quite as bad as the Aussie.

Relative value

Remember, the British pound doesn’t have to be strong, just stronger than the Aussie. That’s what you are measuring it against in this market, and it certainly looks like it could continue to go higher. In fact, it wouldn’t surprise me at all if we hit the 2.00 level given enough time. The Australian dollar of course is getting no real help from the gold markets, which I find odd considering that it was rather bullish in the gold pits on Tuesday.

With that, I believe that you can only buy this pair and would ignore any selling opportunities even though a break below the bottom of the hammer is a fairly soft sign. Ultimately, it is far too much in the way of support and noise below to do such things, meaning that this is a market that should ultimately go higher given enough time.