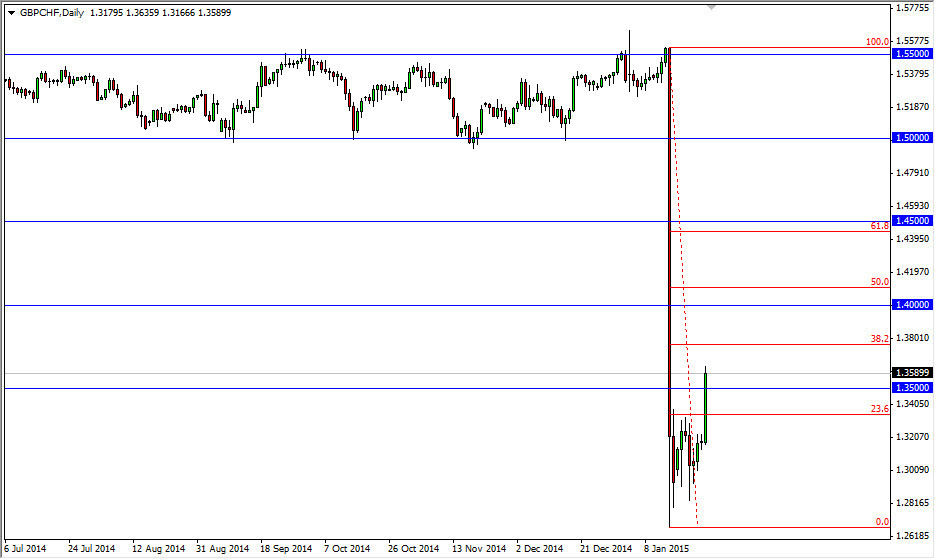

The GBP/CHF pair broke higher during the course of the day on Monday, and even managed to clear the 1.35 handle. Because of this, I have drawn the eighth Fibonacci retracement tool on the chart as well, trying to find some type of convergence. The 1.45 level is the 61.8% Fibonacci retracement level, or at least close to it, and of course a large, round, psychologically significant number. With that being said, I think we are probably going to go to that area, and one can only be described as a countertrend move of an oversold market.

The removal of the currency peg in the EUR/CHF pair through the currency markets into absolute disarray, forming the large red candle that you see on the chart. That being the case, I still believe that this market will continue to sell off, but that type of move typically needs to see profit-taking in order to bring more sellers into the marketplace. After all, you have to wonder who’s left to sell at this point?

Short-term buying opportunity, better selling opportunity later

I believe that this is a short-term buying opportunity, and that it will more than likely be choppy. However, I believe that we will have an even better opportunity later to sell this pair on resistive candles. Although I am pointing out the 1.45 handle, I am willing to take any resistive candle between here and the 1.50 level, as I believe sooner or later the market will start to sell off the British pound against the Swiss franc again.

Another thing you need to pay attention to is the GBP/USD pair. If we break below the 1.50 level and that marketplace, this market will more than likely fall apart as it would show a severe weakening of the British pound in general. With that being the case, you have to keep one eye on each chart but I think ultimately we will get a significant bounce that can be traded. Whether or not we can get below the lows is a completely different question, but I believe that we will be able to sell soon.