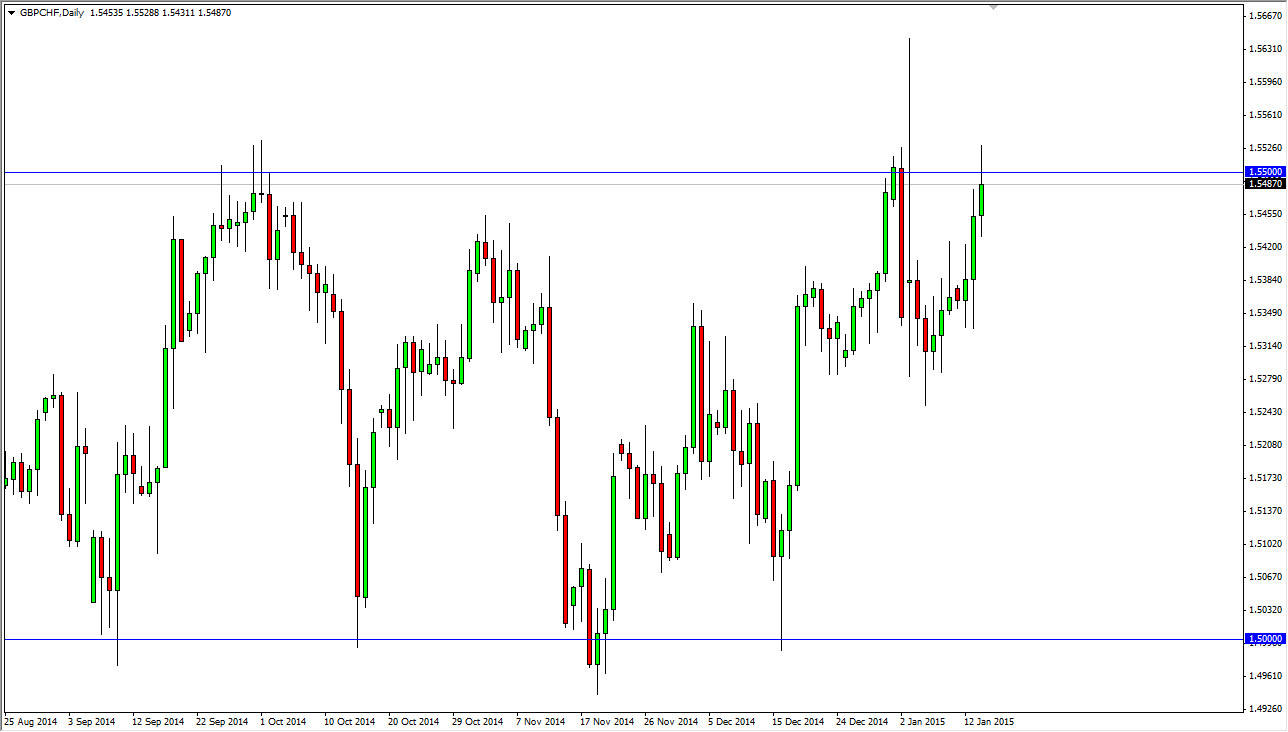

The GBP/CHF pair tried to break out during the course of the day on Wednesday, but as you can see the 1.55 level started offer quite a bit of resistance. Quite frankly, this is the type a break of the scares me simply because we have the massive shooting star from about two weeks ago. That is an absolutely ridiculous candle, and because of that I would have to think that there is a significant amount of selling pressure above.

That doesn’t mean that I’m willing to sell this pair right away either, just that it is a pair that appears to be on the verge of making a fairly serious decision. This coincides with a potential reversal in the GBP/USD pair, so I think this is more about the British pound than anything else. Yes, the Swiss franc is considered to be a “safety currency”, but I don’t think that this is a civil rights back to risk appetite type behavior. I think this is simply a technical move in the British pound itself.

Pullbacks should offer buying opportunities

Pullbacks should offer buying opportunities as far as I can see. A break out above a massive resistance barrier like this normally takes a few attempts. Perhaps the pullback will be a momentum building exercise in order to do such a thing. It will take quite a bit of effort, especially do break above that nasty looking shooting star from two weeks ago. Once we get above the top of that though, you would have to think that we were “free and clear” as far as going long of this pair is concerned.

Keep an eye on this pair, I do believe that a big move is coming, but we may have to chop around in the meantime to make that happen. Ultimately, I don’t really have any interest in selling because I see so much support below the 1.54 region in the form of massive clustering. In other words, if we drop on simply going to look for a buying opportunity below.