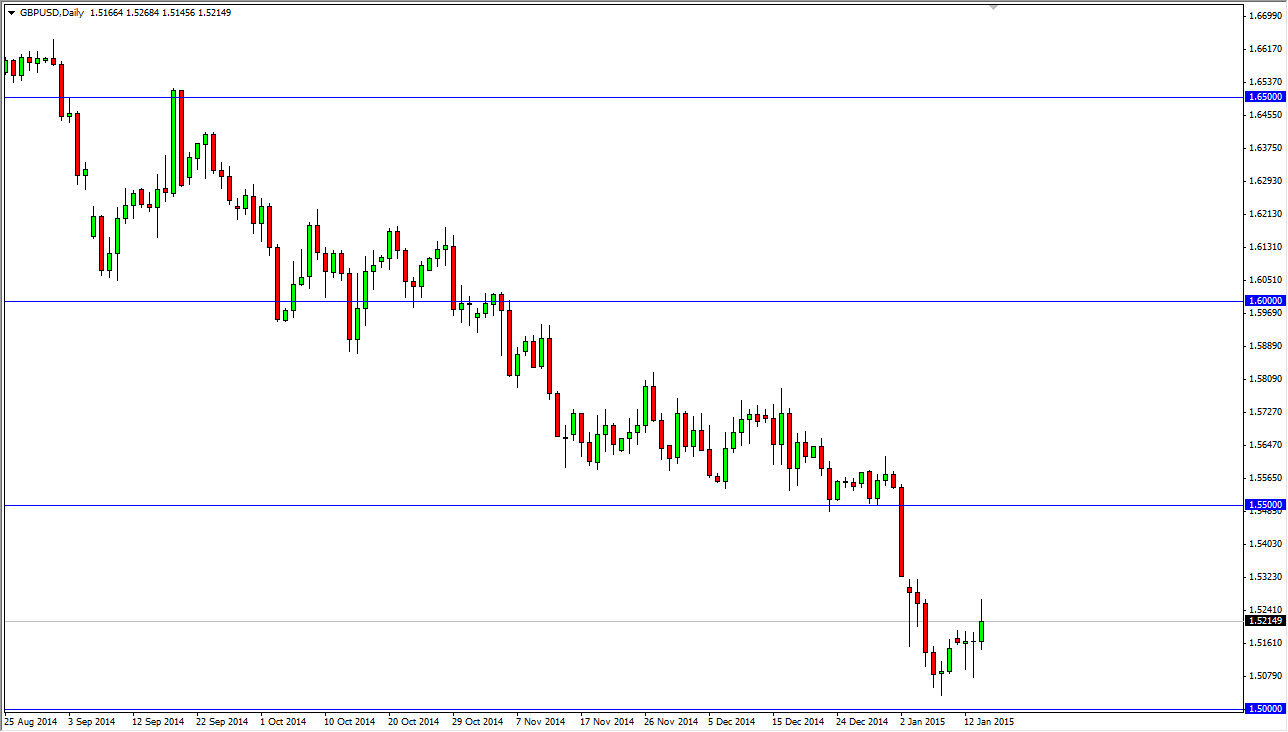

The GBP/USD pair broke higher during the course of the day on Wednesday, breaking the top of the hammer from both Monday and Tuesday, an extraordinarily bullish sign. However, we did get a little bit of a pullback towards the end of the day but that’s not that big of a surprise if you think about it. After all, this is a countertrend move and they do tend to be fairly choppy. With that being said, it will probably be a very volatile right higher, but it does make sense that the buyers would step in and start picking this pair up as we are so close to the 1.50 handle. That level is very supportive on longer-term charts, and is obviously a large, round, psychologically significant number that would attract a lot of attention.

Buying on the dips

I personally buying small mounds on the dips as we go forward. Ultimately, I believe that this market will probably try to get to the 1.55 level but I do recognize that the 1.5350 level between here and there of course is somewhat resistive. I don’t think that it’s a major area by any stretch of imagination, so quite frankly I think that we will get above there. I think that short-term moves are going to continue favor buying the dips, but you of course are going to have to have the wherewithal to hang onto the trade to begin with.

I believe that the 1.55 level is massively resistive, so breaking above there would take quite a bit of pressure. Is because of that that I am not willing to take any longer-term positions right now. However, if we broke above 1.55 and cleared the 1.57 level, and that point time I did willing to call a trend change. Until then though, I believe that short-term buying will probably be the way to go and I will reassess the entire situation as we get closer to the 1.55 handle. Below the 1.50 level, there is support for over 200 pips. Is because of this that I have no interest in selling.