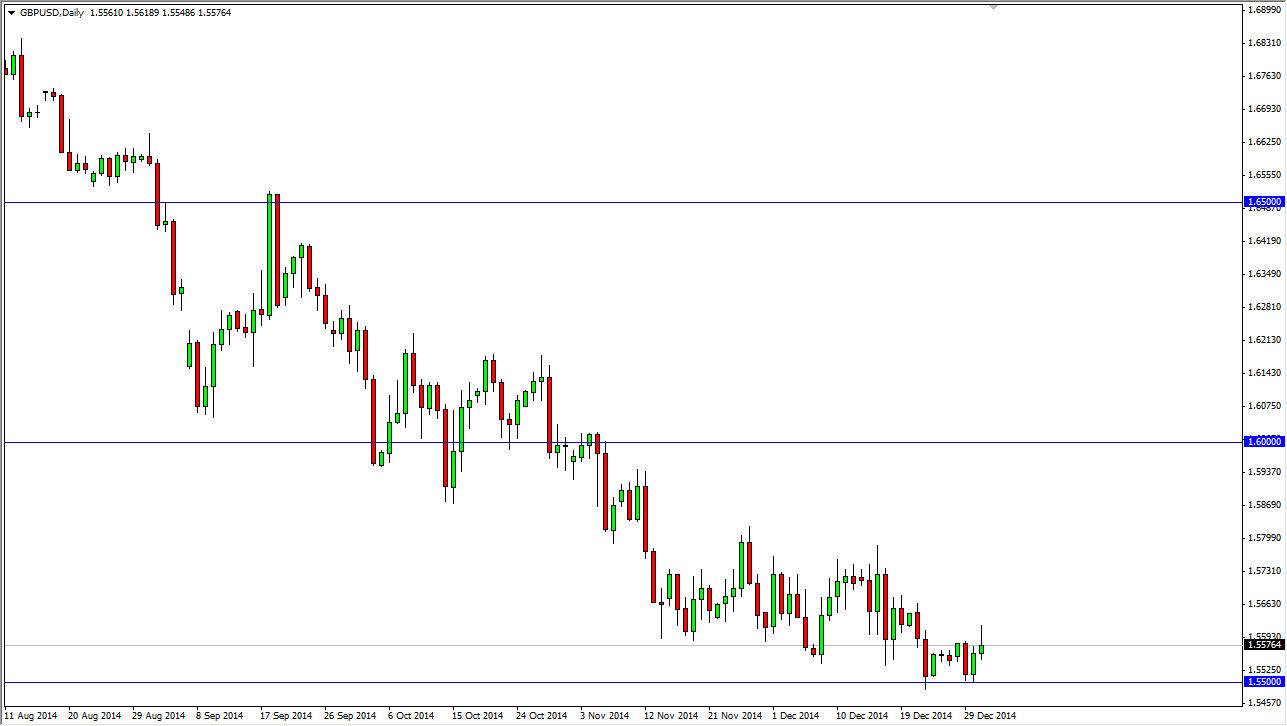

The GBP/USD pair tried to rally during the session on Wednesday, but as you can see struggled above the 1.56 level. In fact, there was enough resistance above there to turn things back around and form a shooting star which of course is a very negative sign. While that much is true, I am a bit hesitant to start selling yet, because I believe that there is a significant amount of support at the 1.55 handle. With that being the case, I am a seller below the 1.55 handle, but will have to wait into we get at least a daily close below there.

Once we do though, I believe that this market then goes out to the 1.50 level without too many issues. Although I’m not necessarily overly bearish the British pound, I am most certainly positive of the US dollar. With that being the case, I don’t see any reason why this market does and continue to fall over the longer term.

Selling rallies

I believe that selling rallies will be the way to go going forward, if we don’t get the breakdown below the 1.55 handle. Any rally at this point time would be treated with immense suspicion by me, as I believe that it is not until we get above the 1.60 level that it is possible to serve buying this market with any type of confidence. I think that ultimately we have to look at this as a question of the US dollar going higher or lower, and truthfully I’m not paying too much attention to the British pound.

I do believe that the 1.50 level could be massively supportive though, so if we do fall down to that area I am actually starting to look for buying opportunities. Between here and there, I would anticipate a lot of noise, thereby causing the market to bounce around quite a bit. It will probably be a situation where you are going to be better off selling short-term rallies and taking short-term trades. I don’t see this as being an easy move lower, but I do think it continues.