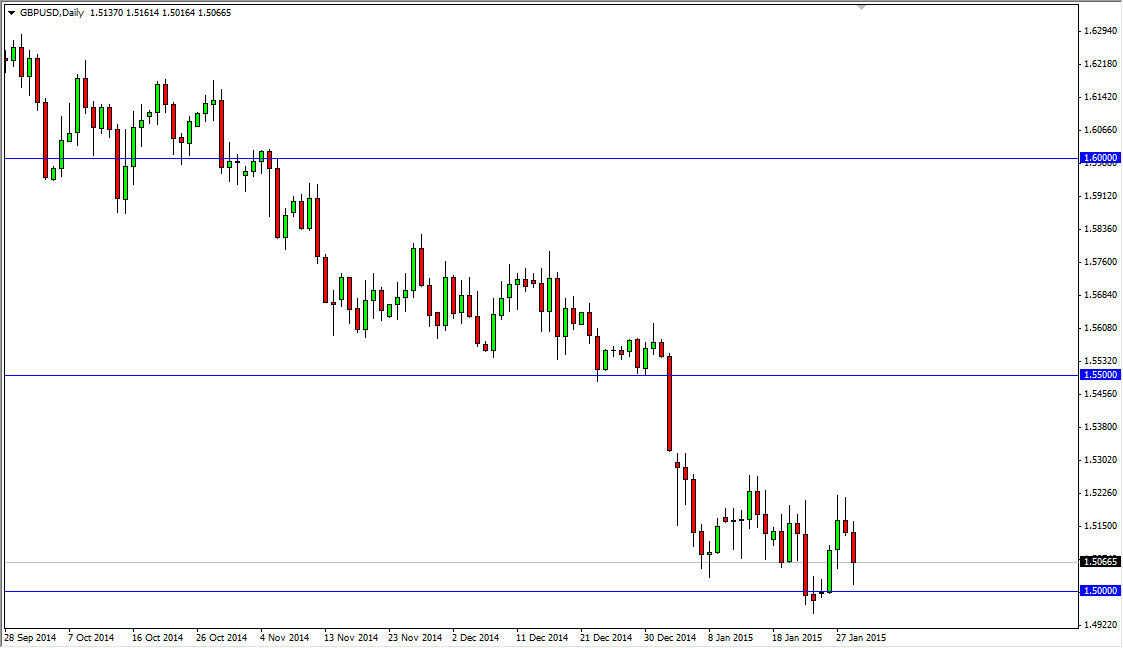

The GBP/USD pair fell during the course of the session on Thursday, as we fell all the way down to test the 1.50 level yet again. However, we did find a little bit of support there and as a result we bounced towards the end of the session. I believe that this pair continues to grind away in this area, but the 1.50 level below could end up being a tough nut to crack. Ultimately though, if we do get below there I think that this pair will grind its way lower, but I see a lot of noise between here and the 1.48 level. Because of this, I am not overly excited to aggressively short the British pound.

I believe that the US dollar continues to strengthen overall, but I do recognize the fact that this pair has been oversold. I think ultimately we do go down to the 1.48 handle, but this will not be the easiest trade to take. After all, extreme amount of volatility typically keep people away from the market, especially the retail trader.

Selling rallies and playing consolidation

I continue to sell short-term rallies and I believe that will be the way going forward. Because of this, it’s ultimately going to be easier to look to short-term charts to try and make short-term gains. However, we will ultimately break down in the end and I think that the US dollar will continue to reign supreme for the next three or four months in the Forex markets in general.

Even if we rally from here, it’s not until we get above the 1.53 level that I would feel comfortable buying. At that point in time, I do think that the market would probably head to the 1.55 level, but at that area would find a massive amount of resistance. With that being the case, I think that any buying opportunity is simply a short-term move and not something that I would well put a lot of money into. I would be even more aggressively short of this pair at 1.55 if we had a negative candle.