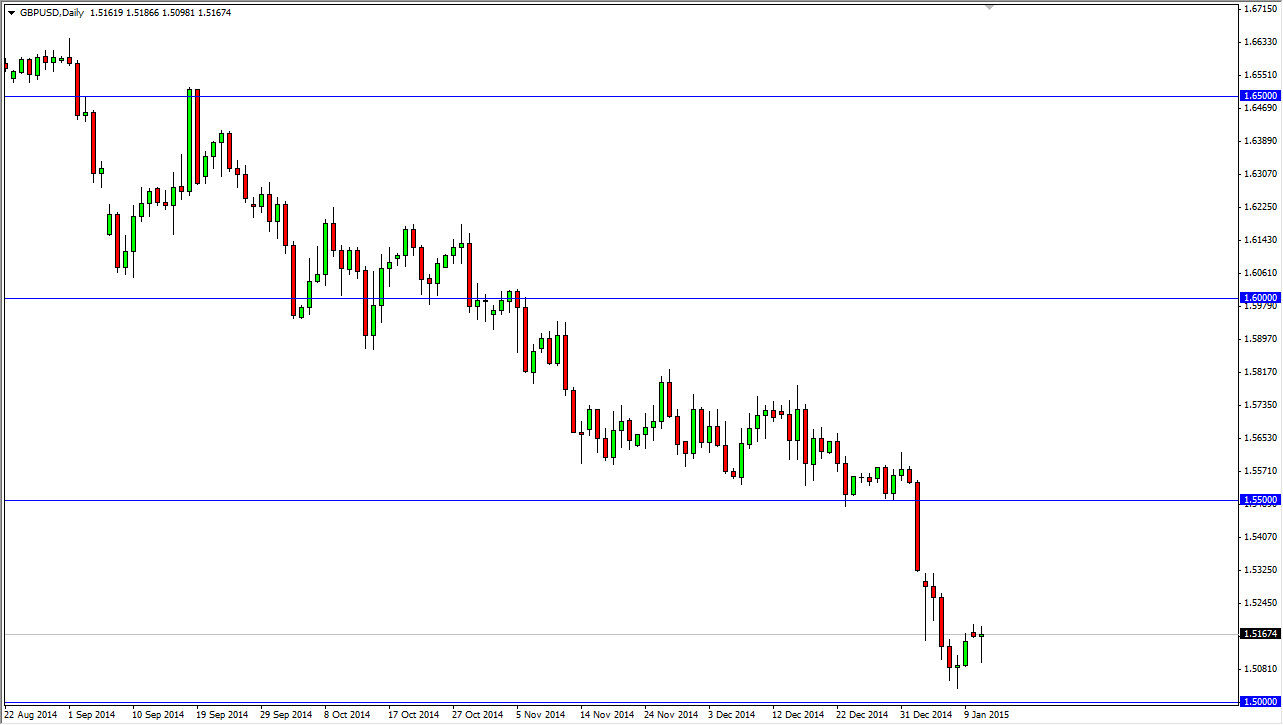

The GBP/USD pair as you can see initially fell during the course of the session on Monday, but found enough support below to bounce and form a nice-looking hammer. That being the case, the hammer looks as if it’s ready to go much higher and perhaps turn things around. That’s not a big surprise, as the 1.50 level is of course a large, round, psychologically significant number. On top of that, it is a massive amount of support on the longer-term charts, which of course extends all the way down to the 1.48 handle. In other words, it is an area that the buyers are definitely sitting at.

Breaking the top of the hammer in our opinion send this market looking for the 1.53 level, and then if we can get above there we should then test the 1.55 handle, which in my opinion is massively resistive. In fact, if we can get above the 1.55 level, I believe that that point in time the trend will change in the British pound will continue to strengthen over the longer term.

Volatility ahead

I believe that there is a bit of volatility ahead, based upon the fact that this is of course a countertrend trade, and that always tends to be that way. On top of that, I believe that the market is in fact going to try to change its trend in general, and that’s never a clean and easy move to have. The way that this market looks to me is like one that is ready to make a massive change, and something like 20 of the last 21 Januarys have seen the US dollar change direction. In other words, this move makes complete sense.

However, if you cannot handle the volatility this will not be the trade for you. Just realize that there is a massive support barrier below that should protect you on a long position, and write out what is certainly going to be quite a bit of noise in both directions.