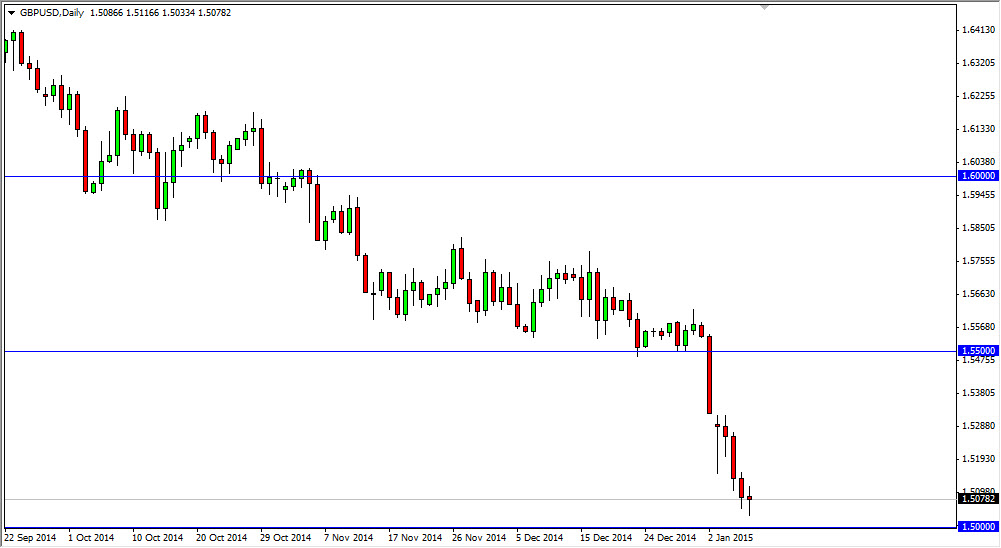

The GBP/USD pair went back and forth during the course of the session on Thursday, ultimately to end up forming a hammer. The hammer sits just above the 1.50 level, an area that I believe is massively supportive. On top of that, I believe that the area is supportive all the way down to the 1.48 level, and it is essentially a zone of support. Because of this, I think that if we are going to see any type of bounce in this pair, it’s going to be in this general vicinity.

The shape of the hammer is perfect, and it is at the right place. Because of this, I think we can break the top of the hammer, we will more than likely head to the 1.53 level, and then possibly the 1.55 level which is a much more significant resistance barrier. The market will be attracted that this, as it always is. However, today is going to be a little bit different.

Nonfarm payroll number will move this market

I believe that the nonfarm payroll number will of course move this market, mainly because it’s going to move the US dollar. This isn’t the only market that is pressing up against significant support, the EUR/USD pair is doing the exact same thing right now. This leads me to believe that perhaps the US dollar is going to get a little bit of a pullback. Not only that, the AUD/USD pair is also pressing up against the 0.80 support level. However, we need to get the announcement out of the way in order to see what the market’s true intentions are.

With that being the case, I believe that if the jobs number into being very poor, it would make sense that several these currencies would bounce against the US dollar as it is without a doubt overbought. Because of this, there is also the possibility of a complete route against both the Pound and the Euro if the jobs number comes out stronger than anticipated. Regardless, today is going to be very interesting. If we break down below the 1.50 level with a significant move, we could start to see the British pound unravel.