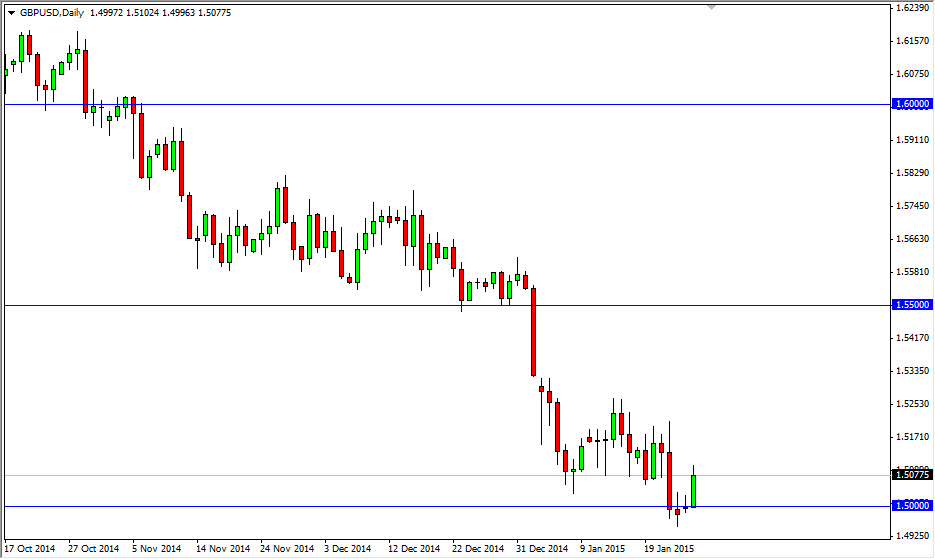

The GBP/USD pair broke higher during the course of the session on Monday as the 1.50 level offered significant support. That being the case, it appears that the market is trying to reenter the previous consolidation area, as the 1.50 area has of course offered enough buying pressure. However, you have to keep in mind that the 1.50 level is a large, round, psychologically significant level as well, and it was more than likely never going to be broken below on the first attempt.

Typically, traders will need to attempt to break through one of these areas several times before it actually happens. Because of this, I think we will bounce a couple of times on shorter time frames, and that should continue to offer selling opportunities going forward.

However, if we break above the 1.53 level, we believe that the market would then head to the 1.55 handle in the short-term, offering a potential buying opportunity. We recognize that it is in fact counter trend, and as a result would be very careful with that type of move.

Selling signs of weakness during rallies

I’ll be selling signs of weakness as this pair rallies. I will use short-term charts to do so, because again, I do not believe that this pair is going to break through the 1.50 level right away. If it does break below there though, the British pound will be insignificant trouble. In the meantime, I would simply anticipate consolidation between the aforementioned 1.50 handle and the 1.53 level. That should offer plenty of trading opportunities back and forth, as the market continues to digest news coming out of the European Union. This is a necessarily an anti-British pound move, it’s just more or less a pro-US dollar one.

Ultimately, expect a lot of volatility in the Forex markets in general, and I don’t think this pair is going to be any different over the course of the next couple of weeks. Keep your position small, and trade the range.