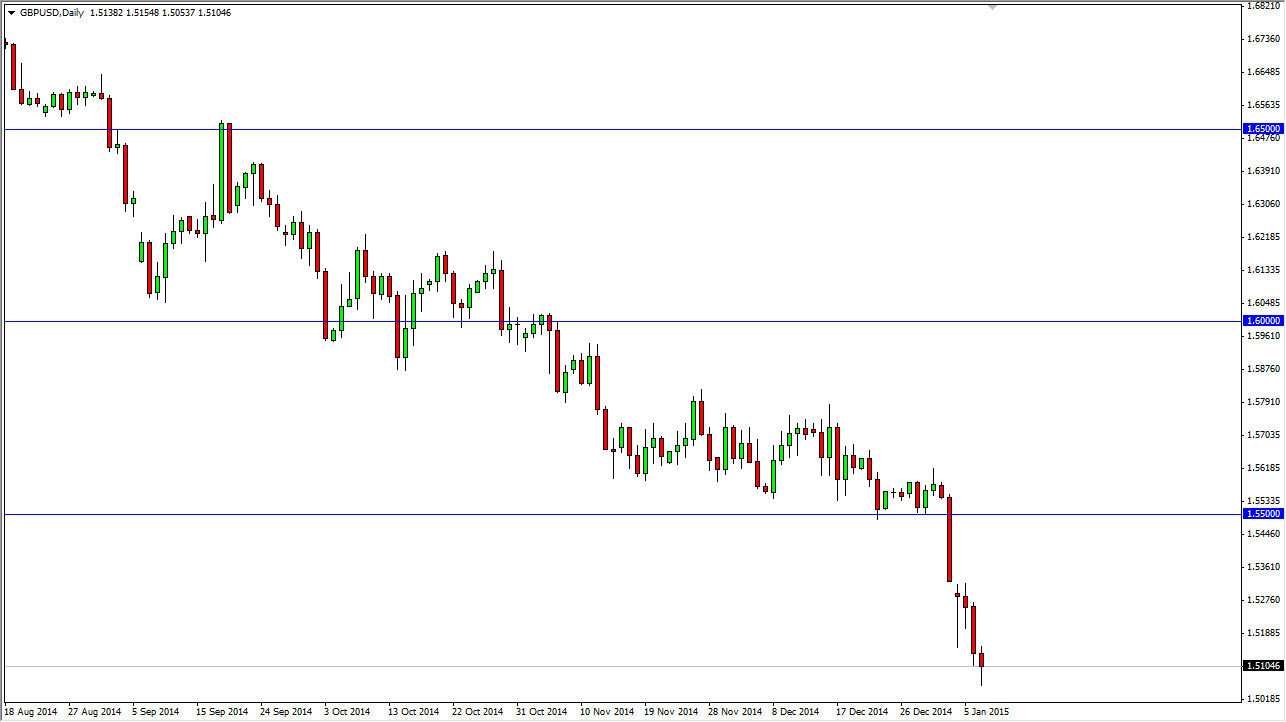

The GBP/USD pair broke down initially during the session on Wednesday as we have seen time and time again. However, we did see buyers step been somewhere near the 1.5050 level, and form a nice-looking hammer. I think there are two things at play here: the 1.50 level below is massively supportive, and the Bank of England has an interest rate announcement coming out later today. On top of that, there’s a monetary policy statement as well, and that of course will move the British pound going forward.

Adding fuel to the fire is the fact that it is nonfarm payroll week, so of course there will be a lot of information coming out about the US economy as well. With that, I think the next two days will be very interesting in this pair. However, I’m the first to admit that this area here is probably the perfect place to see the trend change. The Bank of England could make that happen all by itself with the right wording today.

Patience will be needed

Patience will be needed for trading this pair, but right now I believe that there is serious upside potential. I think that the market could go to the 1.55 level fairly easily, but if we get above there I think the trend has changed. On the other hand, if we break down below the 1.50 level, that could be absolutely disastrous for the British pound. I think we are starting to see the very end of the downtrend, but keep in mind that a lot of times when trends change, it’s a messy affair. It’s pretty rare that trends change on just one candle. They typically bang around in an area where the big players in the marketplace change hands. The fight it out in large amounts of money that you and I can’t even imagine. All we could do is follow the winner. I think we’re getting to the point where the sellers have just about had it with the trend. I will be paying attention but I recognize that there is serious potential for longer-term move here.