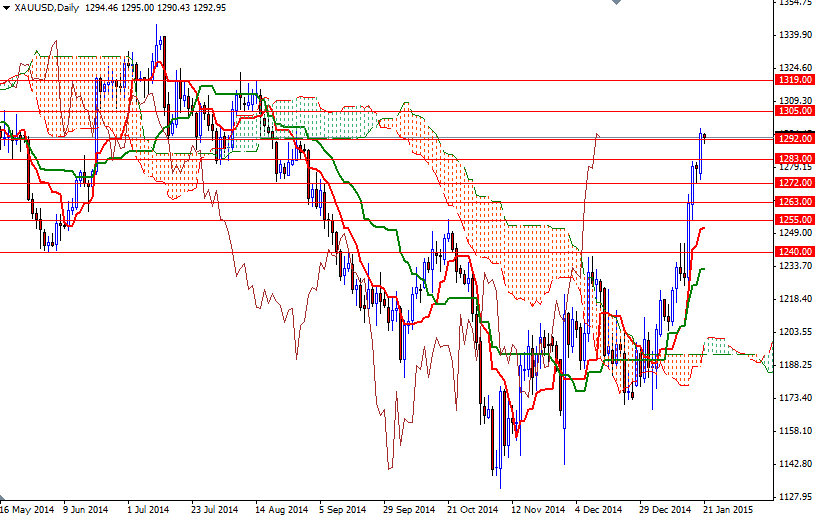

Gold prices ended higher on Tuesday, erasing all of the previous day's losses, as conditions in the market boosted the precious metal's safe-haven appeal. The XAU/USD pair accelerated its advance and hit the highest level since August 20 after the bulls managed to clear the 1283 resistance level. Recently the markets' focus shifted to uncertainty over Europe's economy. Investors have been nervous about tomorrow's European Central Bank meeting, which could see the unveiling of a quantitative easing program.

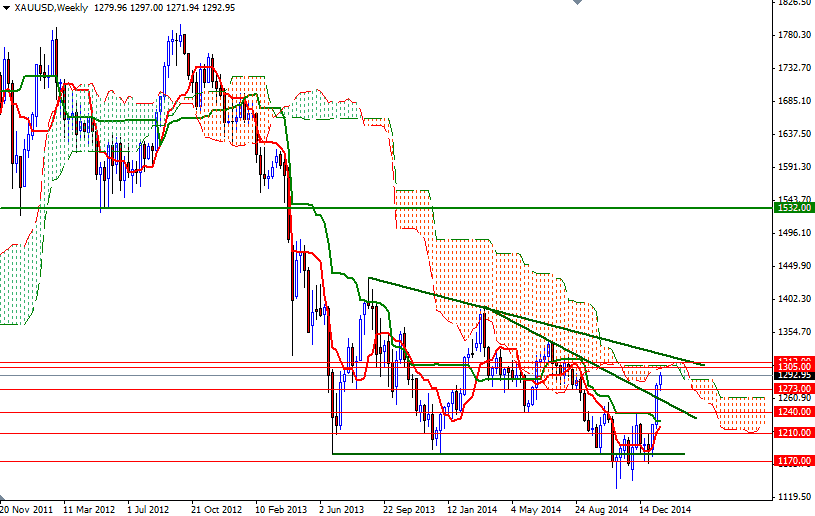

Technical buying pressure was also behind gold's jump yesterday. Breaking through the 1283 resistance triggered a fresh round of buying and pushed prices beyond the 1292 level. The XAU/USD pair has been climbing relentlessly since the daily chart turned positive and as a result the market approached the weekly Ichimoku clouds faster than I thought. The Ichimoku cloud which defines an area of support or resistance (and in our case the weekly cloud means resistance) currently resides roughly between the 1302 and 1308 levels. The thickness of the Ichimoku cloud is important because the thicker the cloud, the less likely it is that prices will manage a sustained break through it. The thinner the Ichimoku cloud, a break through has a better chance.

If the market stays above the 1292 level, the market will probably have enough momentum to touch the bottom of the cloud. A close above 1308 suggests that the XAU/USD pair may extend its gains and target the 1312 and 1319 resistance levels next. However, a failure to hold the market above 1292 could lead to some profit taking and pull us back to the 1283 level. The bears will need to drag the pair below the 1283 level so that they can march towards the 1272 level.