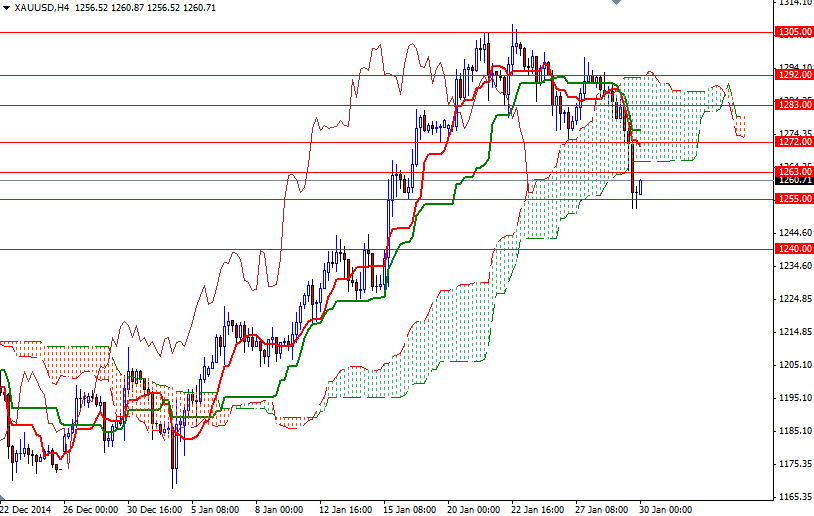

Gold prices fell for a second day and settled at $1256.85 an ounce, losing $27.18, on growing perception the U.S. Federal Reserve is on course to raise interest rates as early as June. The XAU/USD pair fell through the support at the $1272 level after a report released by the U.S. Labor Department revealed the number of first-time applicants for jobless benefits decreased 43K to a seasonally adjusted 265K, the lowest level in nearly 15 years. Not surprisingly, the pair accelerated its decline after the $1263 level gave way and tested the $1255 support as expected.

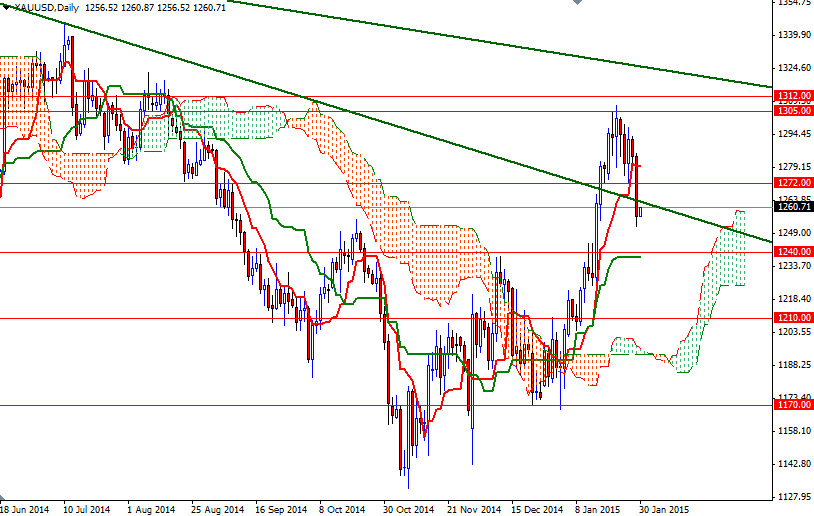

The market has been under selling pressure since sellers stepped in around the 1305 level where the Ichimoku clouds resided on the weekly chart. Yesterday's price action dragged prices back below the cloud (and also a shorter term descending trend-line) on the 4-hour time frame and on the same chart, we have a bearish a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross. as well.

That means the XAU/USD pair will continue to feel pressure unless the bulls pull prices above the 1272 level. But of course, in order to do that, they need to break through the 1263 - 1266.20 area first. Only a close above 1272 would indicate that it is technically possible to see the market revisiting the 1283 level. On the other hand, if the bulls fail to hold prices above the 1255 level and we break below yesterday's low, it is likely that XAU/USD will head towards 1240. I think the 1240 level will to be crucial going forward because this area had been both resistive and supportive several times in the past.