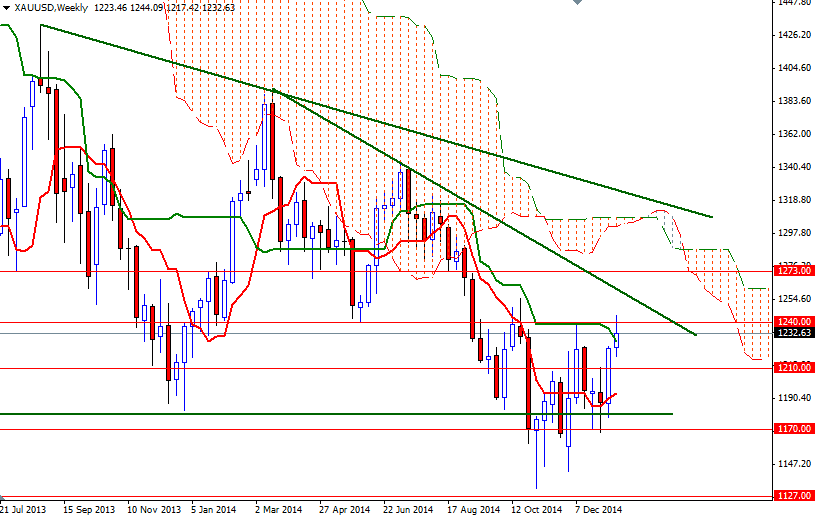

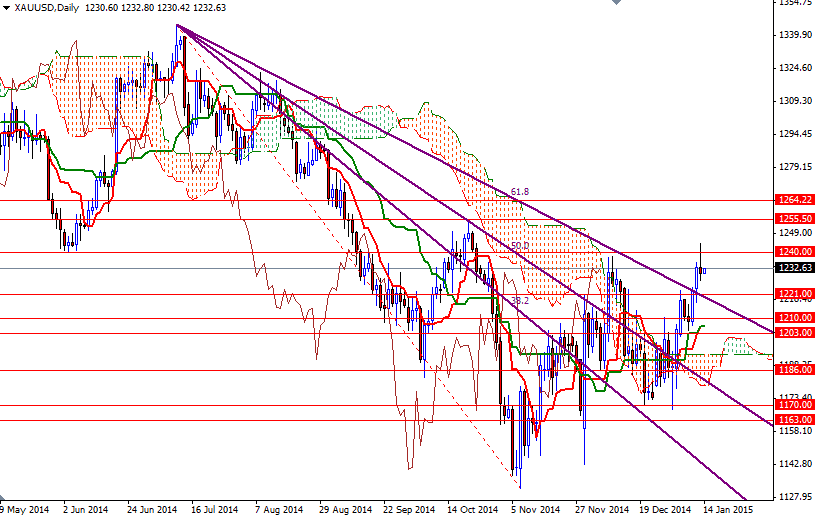

Gold prices ended slightly lower Tuesday on technical selling and signs of stabilization in the risk environment. The XAU/USD pair initially tried to rally during yesterday's Asian session, at one point traded as high as $1244.09 an ounce, but the bulls run out of gas and failed to hold prices above the $1240 level. As a result, the precious metal gave up some of its recent gains and formed a long upper shadow. Currently the XAU/USD pair is trading between the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) on the 4-hour chart.

Lately concerns over political uncertainty in Greece and increasing demand for protection against volatility in global equities markets have been driving this market’s bullish activity but yesterday’s shooting star like candle indicates that some investors aren't too confident in gold. If long-side profit taking continues today, it is very likely that we will see the market testing the intra-day support at 1224.35 (the Kijun-sen on the 4-hour time frame). Breaking this support level would suggest that the 1221 level might be the next stop.

The pattern on the charts (and the fact that prices are trading above the Ichimoku clouds) suggests the medium term directional bias remains weighted to the upside. That means any pullbacks will attract buyers into the market until the technical outlook changes. However, as I mentioned earlier, I believe the 1240 level is a strategic point for the bulls to conquer in order to advance towards the 1252 - 1255.50 resistance area. Closing beyond 1255.50 would make me think that the market is ready to tackle the next strong resistance at 1263(6).