Gold prices closed lower on Wednesday, giving back a portion of the previous day's gains, as the greenback strengthened after the Federal Reserve boosted its assessment of the economy and labor market. In a statement after its two-day meeting, the Federal Open Market Committee said "Economic activity has been expanding at a solid pace. Labor market conditions have improved further, with strong job gains and a lower unemployment rate". Although the Fed remained upbeat about the economy, it acknowledged the weakness on a global basis, saying that it will take into account readings on international developments as it decides when to tighten monetary policy.

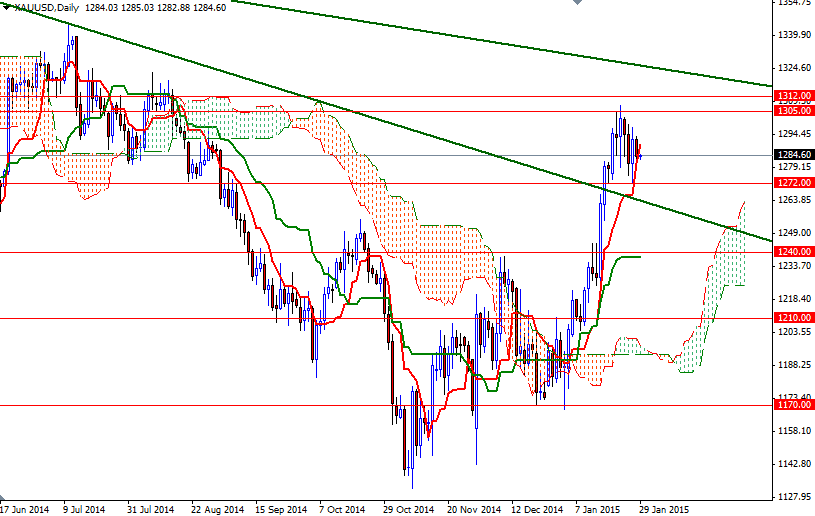

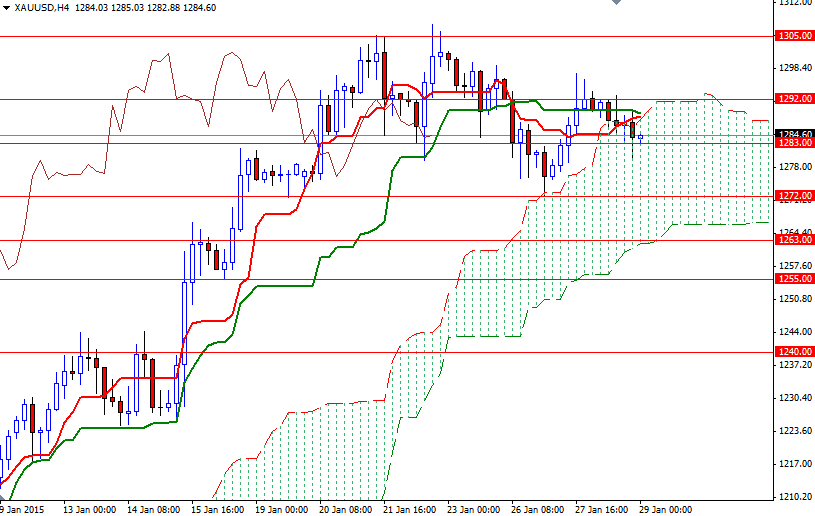

From a technical perspective, there are two things that I pay attention at the moment. Firstly, the bulls have been trying to establish a medium-term uptrend while holding the market above the Ichimoku clouds on the daily chart but the bears still have the long-term technical advantage. Secondly, the XAU/USD pair is currently trapped within the borders of the cloud on the 4-hour chart, plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. That means the market will be looking for a direction in the near term.

With that in mind, I think the XAU/USD pair will need to break either above 1292/5 or below 1266/3 in order to gain some momentum. If the bulls shatter the first barrier ahead of them, then it may be possible to see the XAU/USD pair testing the next resistance at 1305/8. Closing above the 1312 resistance level on a daily basis could provide the bulls extra fuel they need to tackle the next hurdles at 1319 and 1325. However, the inability to climb above the 1292/5 region might lead to further downward pressure. In that case, I think we are going to head back towards the bottom of the cloud on the 4-hour time frame. Dropping below 1263 would make me think that the bears are strong enough to test the support at 1255.