Gold ended the day almost unchanged as the market took a breather after surging to a four-month high on Friday. The market initially tested the support around the $1272 level but recovered some of earlier losses at the end of the day. Aside from heightened need for disaster insurance, gold is also being supported by renewed concerns over Greece. Greek parliamentary elections on January 25 is widely expected to result in victory for the anti-austerity party Syriza.

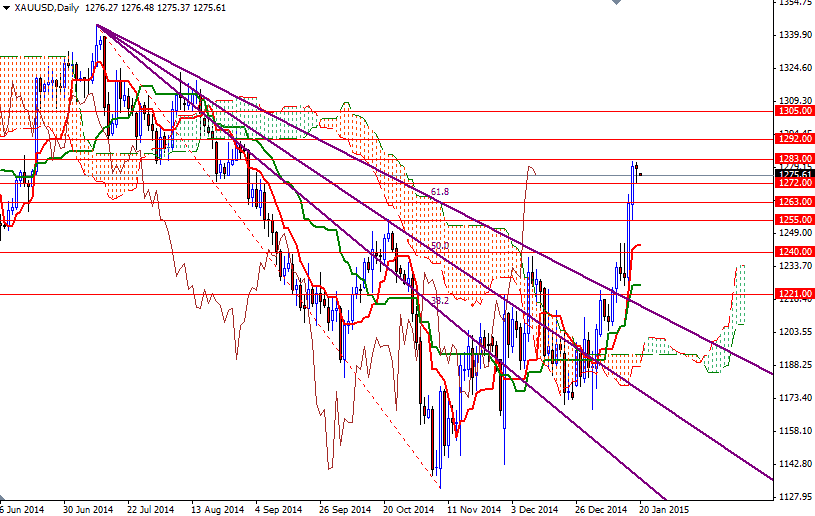

I don't think Greece has the potential to cause a chain reaction but I wouldn't want to hold a short position over the weekend. Recently we have been trading within the tight trading range of 1272 to 1283, so short term traders should pay attention to these levels. If the bears take the reins and drag prices below 1272, they may have a chance to revisit the next support at 1263. A daily close behind this level would indicate that the bears are aiming for 1255.

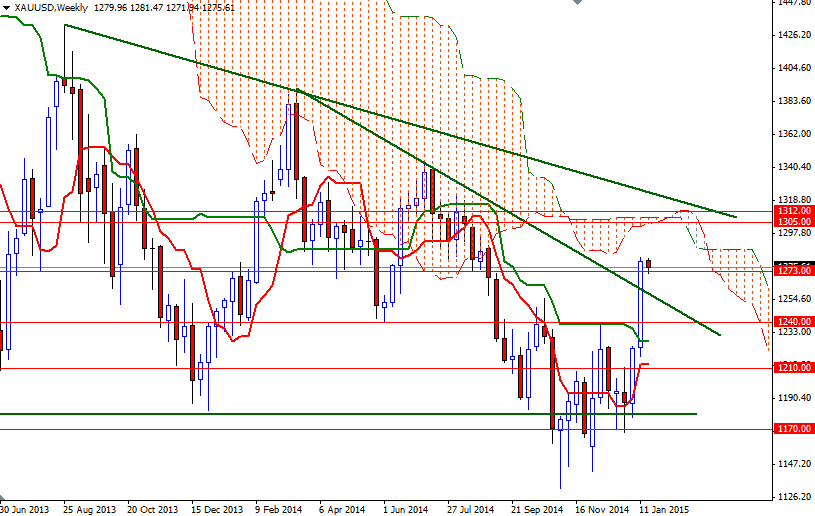

Technically, trading above the Ichimoku clouds on both the daily and 4-hour charts gives the bulls an advantage but I am also aware that the market is approaching the weekly clouds. As you can see on the weekly chart, the XAU/USD pair spent a significant amount of time between the current and 1312 levels. In other words, we may need a strong catalyst (that could be the ECB meeting) in order to reach the clouds. If the XAU/USD pair manages to climb above 1283, resistance can be found at 1292.