Gold prices rose $11 an ounce on Tuesday, propelled by a disappointing report on U.S. durable goods orders and a weak session for equities that helped push the precious metal into positive territory for the first time in three sessions. The XAU/USD pair passed through the $1283 resistance level and traded as high as $1297.45 after data released by the Commerce Department revealed that orders for durable goods fell 3.4% in December.

For the last few months, underlying demand for gold is being held up by the intensified concerns over the global economy and growing conviction the Federal reserve will hold off raising interest rates longer than anticipated. It appears that the market is digesting recent gains as the majority of traders are awaiting the outcome of the Federal Reserve's monetary policy meeting, which they think could show a more dovish bias due to weaker foreign economies.

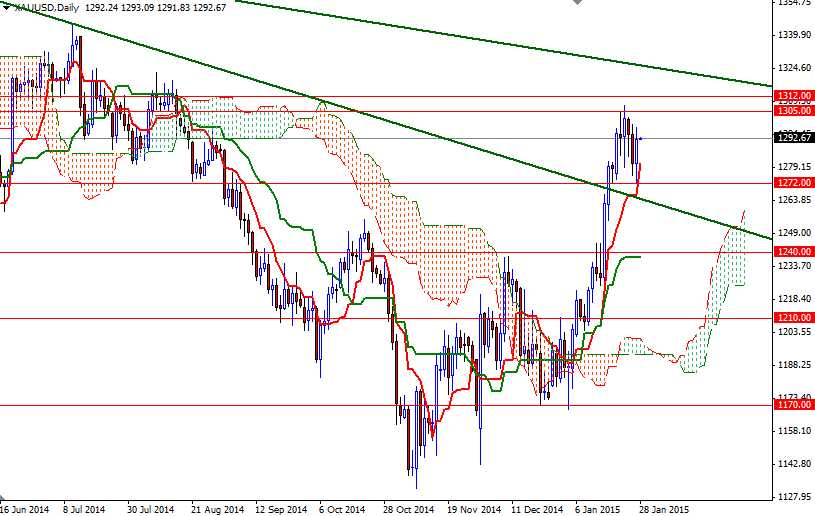

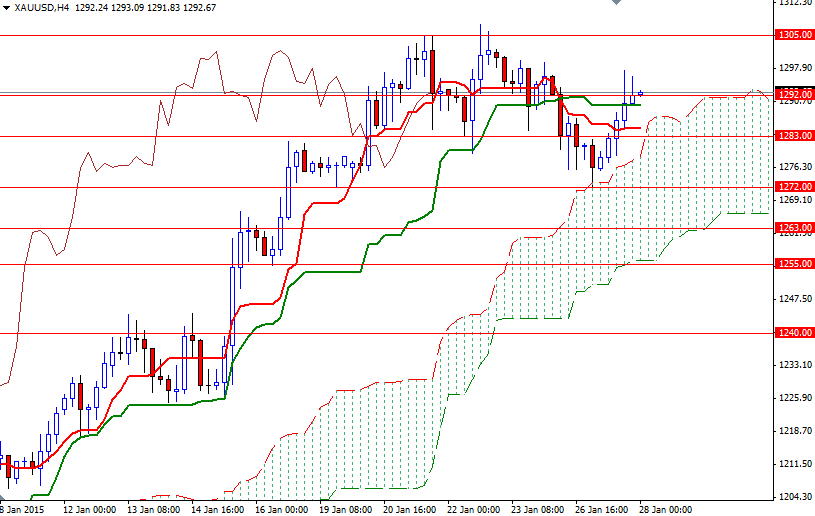

Technically, medium term outlook will remain bullish while prices trade above the Ichimoku cloud on the daily and 4-hour time frames. However, the XAU/USD pair has been making lower highs and lower lows since the market failed to stay above the 1305 level. Because of that I think the pair has to push its way through the 1305/8 resistance zone in order to gain more momentum and tackle the next barrier at 1312. Closing above the 1312 level would indicate that the bulls are aiming for 1319 and 1325. If the bears increase downward pressure and drag prices back below 1292/0, we might test the support in the 1284.70 - 1283 region. They will need to break the support at 1283 if they intend to revisit the 1272 level.