Gold prices hit the highest level since mid-August after the European Central Bank announced a more robust than expected quantitative easing program in a bid to revive the moribund euro zone economy. Quantitative easing is considered as a positive element for gold because it encourages market players to hedge against the declining value of currencies. The next key event for the market is going to be Sunday's snap election in Greece. Polls suggest anti-bailout party Syriza is on track to emerge as the biggest party in parliament.

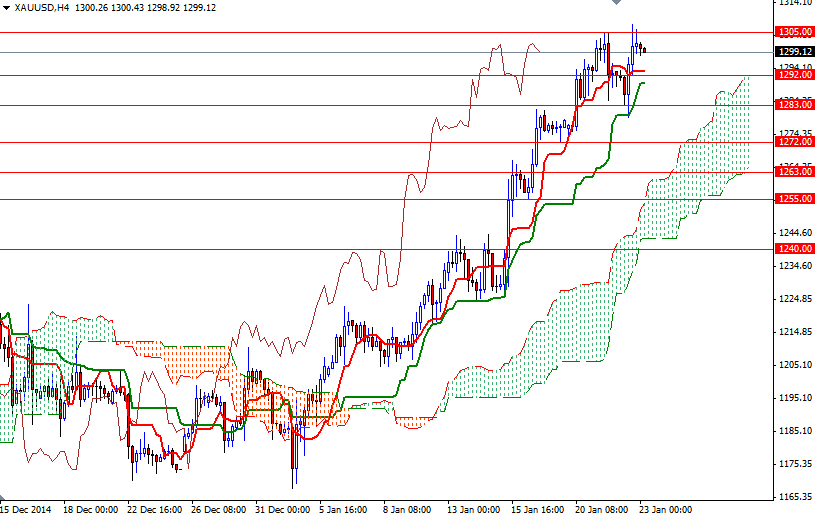

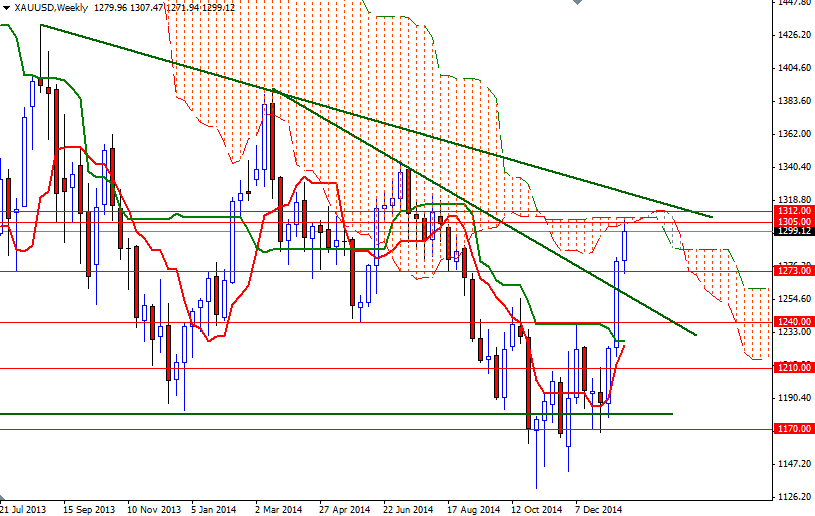

Technically, trading above the Ichimoku clouds on both the daily and 4-hour time frames gives buyers an advantage. Yesterday's candle shows buying interest continues to emerge on dips but it also indicates that breaking through the weekly Ichimoku clouds is essential for a bullish continuation towards the long term descending trend-line originating in August 2013.

If the bulls build up enough steam and penetrate the 1305/8 barrier, then it will be possible to see the market challenging 1312 and perhaps 1319. Once beyond that, there is little to slow down the bulls' advance until the 1329.10 level. However, if the bears manage to defend their camp and prices start to fall, expect to see some support in the 1292 - 1289.70 area. Breaking below this support means the XAU/USD pair is heading back to 1283. The bears will have to capture that point if they intend to retest the 1273/2 support.