Gold prices ended Friday's session up 1.35%, or $17.05, to settle at $1279.47 an ounce as disappointing U.S. economic data stoked speculations the U.S. central bank may hold interest rates extremely low for longer than previously thought. The Labor Department reported the consumer price index fell 0.4% in December. A separate report from the Federal Reserve showed industrial production dropped 0.1% last month. The aftermath of Thursday's surprise from the Swiss National Bank also continued to encourage buyers. On Thursday, the precious metal finally broke above the $1240 resistance and jumped 2.7% following the Swiss National Bank’s move to abandon its policy of intervening in currency markets to prevent undesirable strength of the franc.

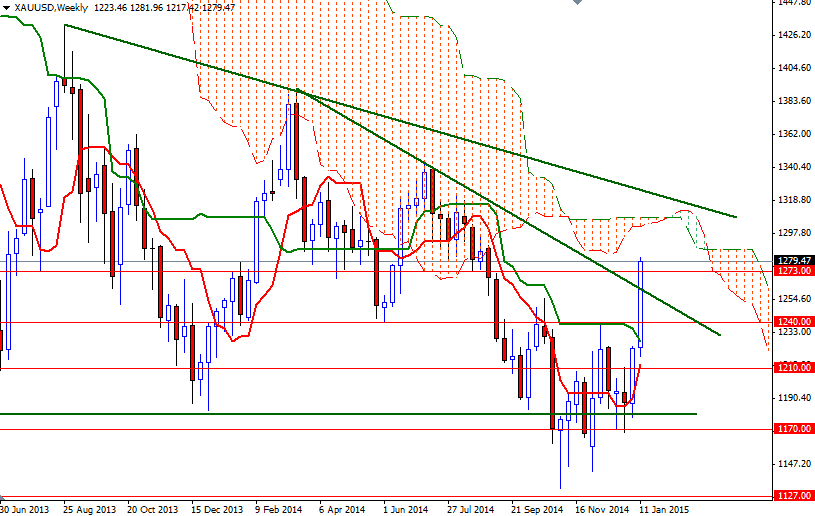

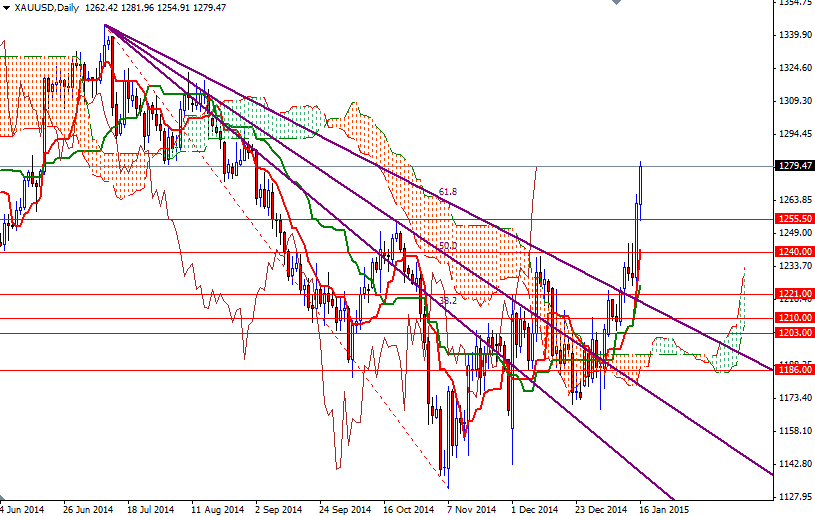

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 130226 contracts, from 122178 a week earlier. The bulls have been dominant since they defended their camp in the 1170/63 area and push prices back above the Ichimoku cloud on the daily time frame. Pattern on the charts suggest that there is still more room to the upside.

As I mentioned in the quarterly analysis, the area between the 1287 and 1310 levels will possibly be the bulls' ultimate target in the near term. Since the weekly cloud and the long term descending trend-line (dating back to the August 28, 2013 high of 1433.70) converge in that zone, this zone could attract seller and trigger profit taking - of course under normal circumstances. However, if the XAU/USD pair encounters heavy resistance and prices start to fall, expect to see support at 1272, 1263 and 1255. Closing below 1255 means we are heading back to the 1240 level which the bulls had struggled to break through.