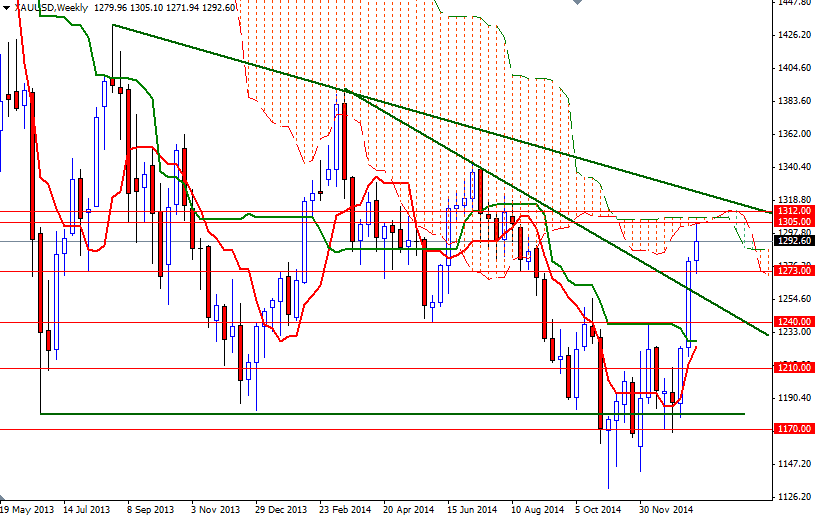

Gold prices settled lower on Wednesday as investors cashed in recent gains after the market failed to breach the $1305 resistance level. The XAU/USD pair initially rose during yesterday's session but we encountered selling pressure at the bottom of the weekly Ichimoku cloud. As a result, prices retreated to the $1283 support before bouncing back to $1292.

Much of the volatility was driven by news that the European Central Bank proposed spending €50 billion each month as part of its quantitative easing program. Although I don't think that the stimulus measures will change all the situation in Europe (because the ECB can only stabilize markets and support the economy; growth-enhancing steps have to taken by national governments), the impact of the move on the euro and the dollar will clearly be something to watch. As we often say, its not the news, but the markets' reaction to news that matters.

The XAU/USD pair is currently hovering around the 1292 level and from a technical perspective I think 1283 and 1305 will be the key levels to watch. If the bulls regain their strength and carry the market beyond 1305, it is likely that we will be testing 1308 and 1312. Closing above the 1312 resistance level could provide the bulls extra momentum they need to tackle the next hurdle at 1319. On the other hand, if long-side profit taking accelerates and prices break below 1283, the market may head back to the 1273/2 support. Once below that, I think the next stop will be 1263.