Gold prices ended the first trading day of 2015 slightly higher as a larger-than-expected decline in U.S. manufacturing data counteracted the impact of a stronger dollar. The market initially fell to its lowest level in a month but rebounded after the Institute for Supply Management said its index of national factory activity declined to 55.5 in December from 58.7% a month earlier. Since the Federal Reserve tied future monetary policy (i.e. timing of interest rate hikes) to economic performance, investors pay more attention to signs of slowdown in the economy.

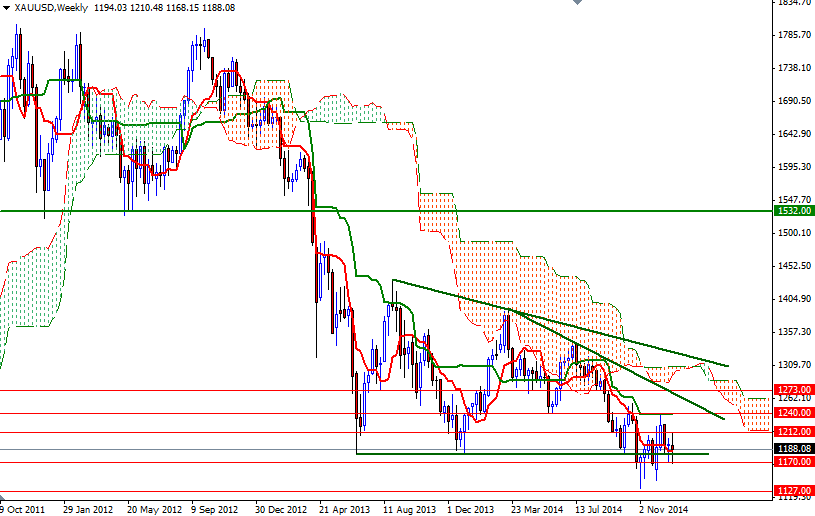

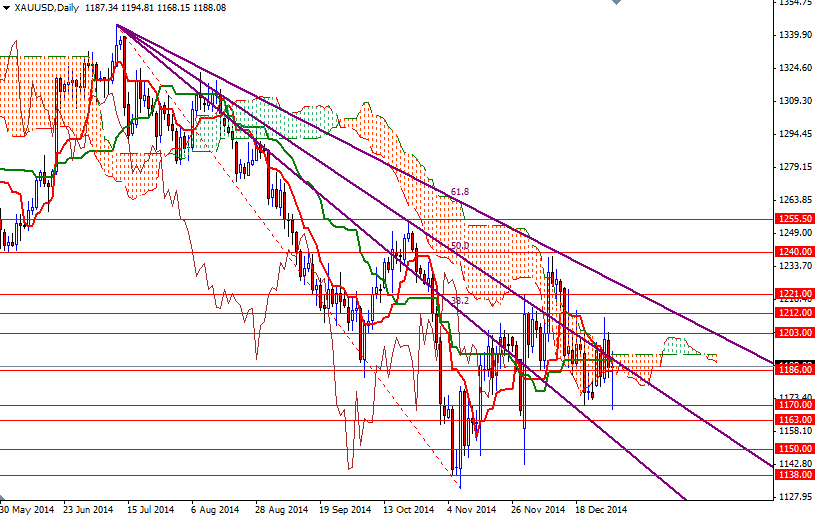

The U.S. dollar’s strength across the board is working against gold but rebound off the $1170 support level suggests that buying interest continues to emerge on dips. The market spent most of the week inside the Ichimoku clouds on the daily time frame and it demonstrates that there is an intense battle going on between the bears and bulls. Because of that, I will be focusing on the 1212 and 1163 levels.

Resistance to the up side can be found at 1193.55 and 1203. Closing above the 1203 level would imply that the short-term technical outlook is shifting to the upside but I think the XAU/USD pair has to push its way through the 1212 resistance level in order to gain enough traction to challenge the critical barrier at 1221. On the other hand, if the bears increase the pressure and prices drop below 1182/0, we might see the market testing the 1178/6 area once again. As I mentioned last week, support 1163 will continue to remain as a key level to the down side.