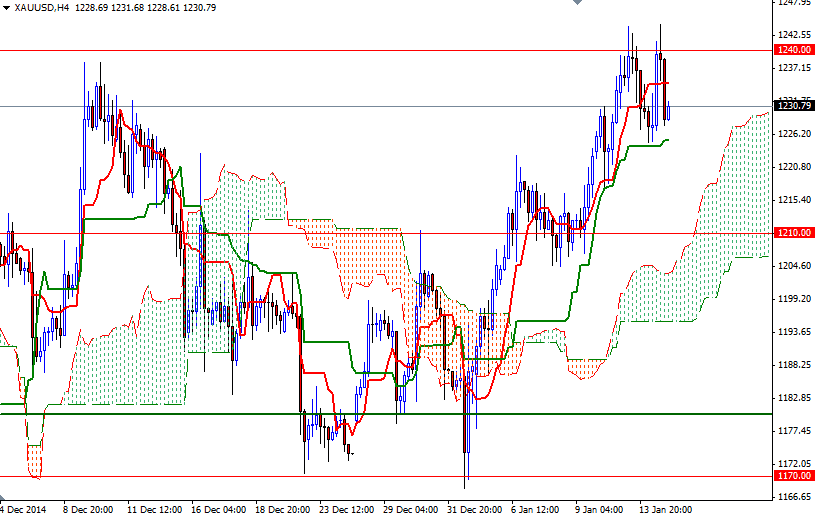

Gold prices settled lower yesterday, extending losses to second straight session, as the bulls failed to overcome the resistance around the $1240 level. The precious metal rose to a high of $1244.30, its highest since October 23, as the American dollar weakened after a report from the Commerce Department showed retail sales declined %0.9 in December but long-side profit taking weighed on the market.

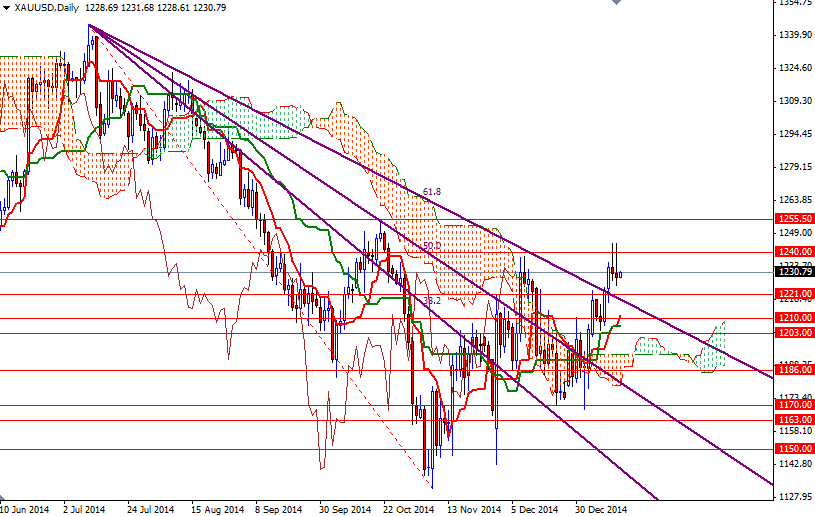

The pattern on the daily chart (two shooting stars off the 1240 resistance in a row) suggests that the bulls find it difficult to gain strength. Of course this is not so surprising after all because the XAU/USD pair paused or reversed around that level several times in the past - note that it is about half of the distance between the July 10 high of 1344.92 and November 7 low of 1131.96. To put it shortly, breaking through this barrier is essential for a bullish continuation. In that case, I think we will test the 1252 - 1255.50 area next.

Right now prices are between the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) on the same chart and as you can see both lines are flat at the moment. If the market drops behind the 1224.35 level, I think we will visit 1221. The bears have to drag prices so that they gather enough strength to challenge the bulls at 1217 and 1210. Today sees release of important economic reports such as producer price index, unemployment claims and Philadelphia Fed manufacturing index, so expect some volatility.