Gold prices advanced on Monday to log their highest settlement in nearly three weeks as political turmoil in Greece and weakness in equities spurred demand. European shares were under pressure after the Greek bourse continued to sink and sharp falls in regional inflation numbers out of Germany stoked fears of deflation. Both the Dow Jones and S&P 500 had their worst day in about three months, with energy shares leading the decline. In the meantime, Asian stocks are extending their losses.

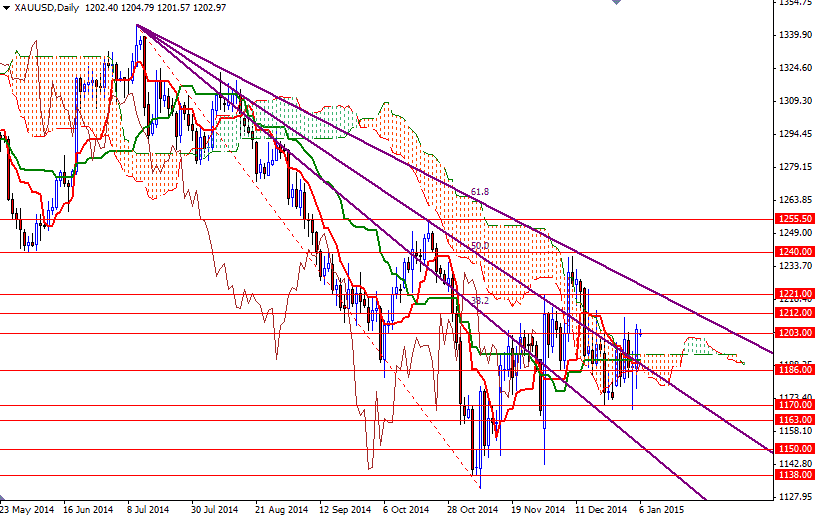

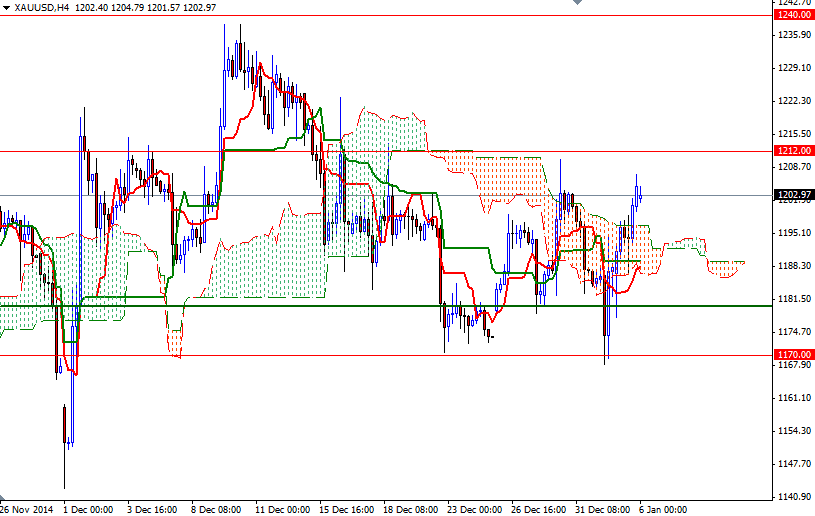

Since the precious metal tends to gain during times of uncertainty, the major equity markets and USD/JPY pair will be on my radar. If we see deeper corrections, market players may decide to shift their money from stocks to the gold market. As I mentioned in yesterday's analysis, buying interest around the $1170(/63) area caught my attention and that makes me think that the odds are favoring higher prices at the moment. Technically, trading above the Ichimoku clouds on both the daily and 4-hour charts gives the bulls an advantage.

The first hurdle gold needs to jump is located around the 1212 level. If the bulls manage to climb and hold prices above that level, they may find a new chance to test the next resistance at 1221. I think breaking through this barrier is essential for a bullish continuation towards 1235/40. However, if the market encounters heavy resistance and starts to retreat, expect to see support at 1193.54, 1190 and 1186. Closing below the 1186 support level would suggest that the bears are going to target 1180 next.