Gold continued to retreat from a five-month high struck last week, as sings of stabilization in the risk environment and buoyant global equities lured some investors away from the market. The victory of the radical left-wing Syriza party in the Greek parliamentary elections didn't cause a catastrophic disruption, prompting some investors to book their profits. The market’s focus will now turn back to the U.S. economy and Federal Open Market Committee’s two-day policy meeting which kicks off today.

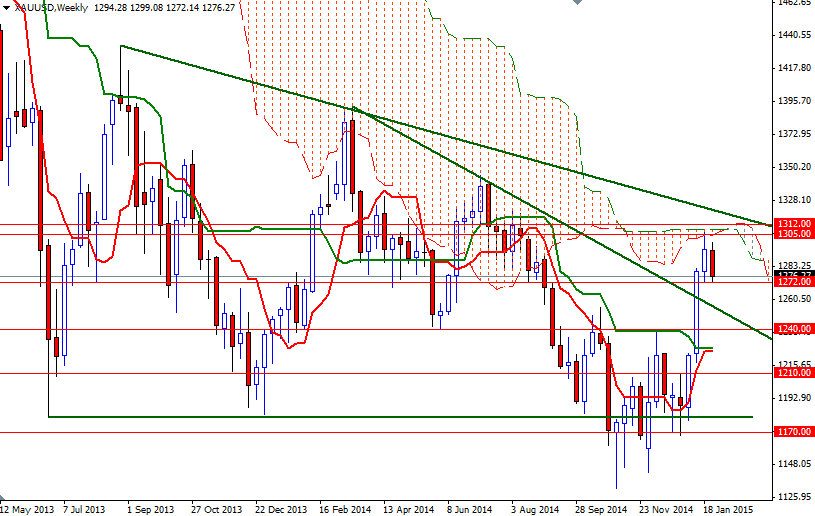

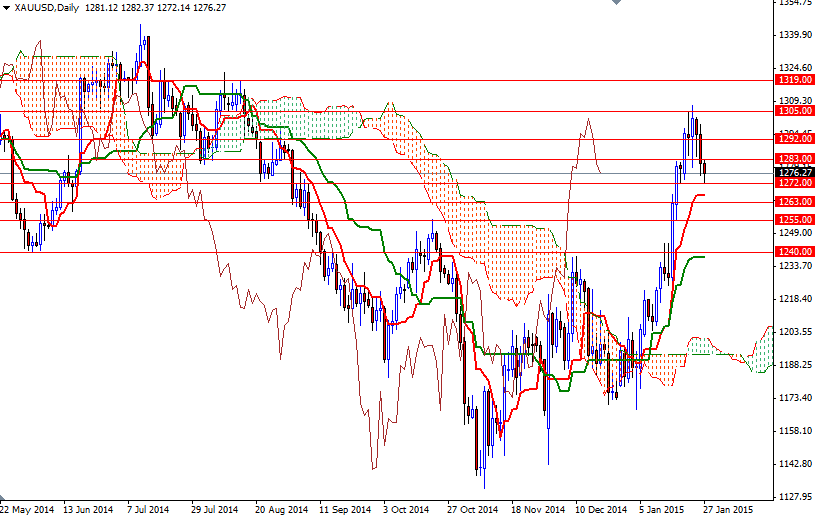

After breaking below the $1283 level, the XAU/USD pair tested the support at $1272 as expected. Although the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned on the 4-hour time frame, the Ichimoku cloud currently occupies the area between the 1272 and 1255 levels. That means we will have to pay attention to this region rather than specific levels.

If prices get support the cloud and start to rise, resistance may be found at 1283. I think breaching this barrier will pave the way towards the 1290/2 resistance. Beyond that, the bulls will be waiting in the 1305/8 area. I have been bullish on the XAU/USD pair for the last couple of weeks, however, if the bears take the reins and prices make a sustained break below the 1272 level, then I wouldn't eliminate the possibility of a deeper pull back towards the 1255 support level. A daily close below 1255 would suggest that the 1240 level might be the next stop.