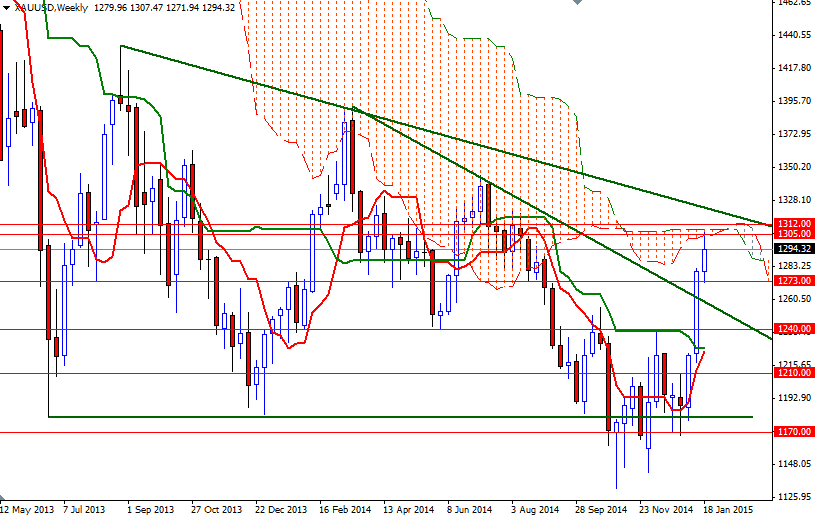

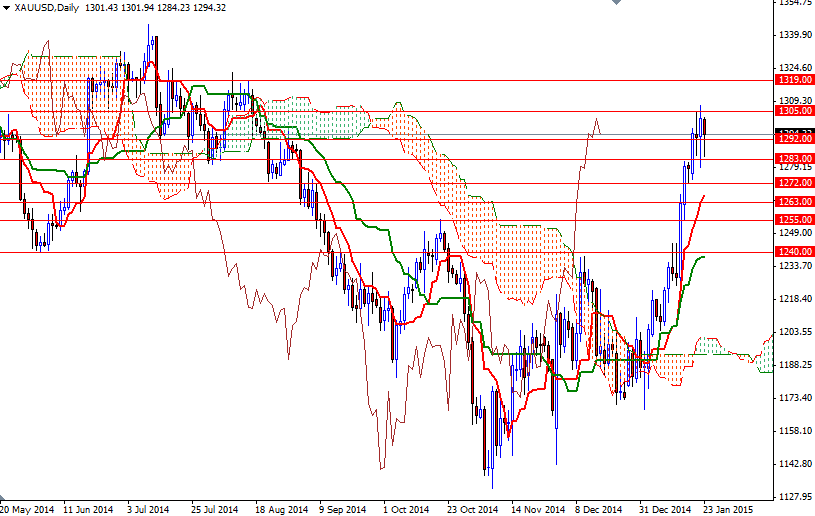

Gold settled down $7.11 at $1294.32 an ounce on Friday but scored a gain of nearly 1.2% for the week as the currency turmoil in Europe and euro's sharp decline in the wake of the ECB's quantitative easing announcement sent investors toward safety plays. Gold has climbed 9.1% this year as subdued inflation and signs of cooling global economic growth spurred speculation that the Federal Reserve will be slow to raise U.S. interest rates but the last few sessions saw bearish pressure due to fact that the bulls failed to penetrate a strong resistance around the $1305 level.

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 171455 contracts, from 130226 a week earlier. The price action in the last three sessions suggest that the battle between the bulls and bears for supremacy intensified in the 1283 - 1308 battle field. The weekly Ichimoku cloud which occupies the area between the 1305 and 1308 levels has been blocking the way lately and because that I think shattering this barrier may signal a run to 1327/8. On its way up, there will be hurdles such as 1312 and 1319.

However, if the bears take over and the XAU/USD pair drops below 1283, then witnessing a test of the 1273/2 region wouldn't be so surprising. Closing below this support on a daily basis would make me think that the 1263 level will be the next stop. Going forward, the bulls will have to defend the area between 1255 and 1240 unless they don't want to lose the control and see prices heading back to the 1210 level.