Gold prices ended Tuesday's session up 1.32%, or $15.64, to settle at $1218.34 an ounce as Greece’s political crisis and a tumble in global equities buoyed the precious metal’s safe-haven appeal. The debate around the possibility of elections later this month resulting in the country leaving the eurozone has been rattling the markets recently. Softer-than-expected U.S. data also increased gold's attractiveness as an alternative investment. Yesterday, the Institute for Supply Management said its index of non-manufacturing activity dipped to 56.2 from 59.3 a month earlier and data released by the Commerce Department revealed that new orders for manufactured goods dropped 0.7%.

After three consecutive days of gains it appears that the XAU/USD pair steadied below the 1221/5 resistance level during the Asian session today. The main event of the day will be the release of the minutes of the Federal Open Market Committee meeting held on December 16-17. These records could provide insight into Fed officials' discussion on when to hike rates from current rock-bottom levels but until that time investors may opt to remain on the sidelines.

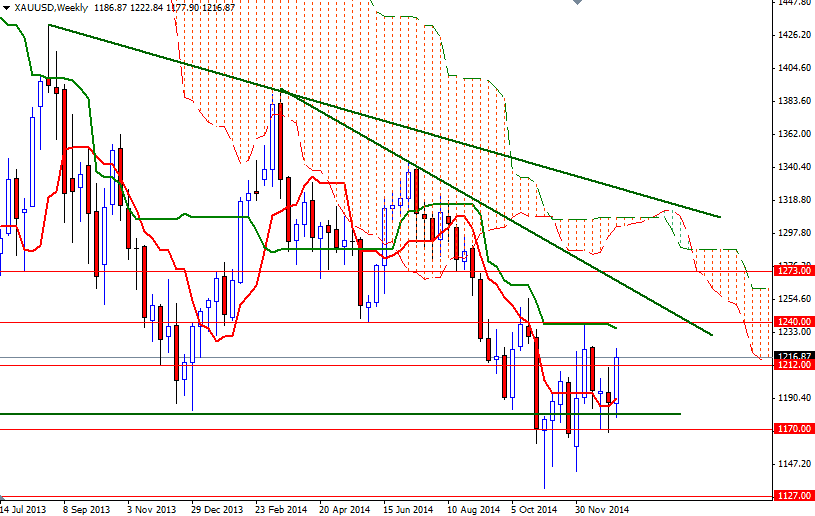

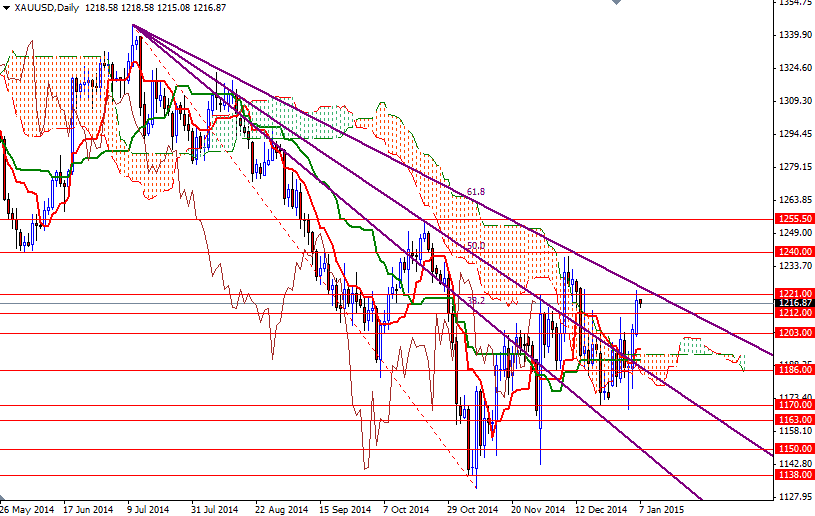

In that case, the XAU/USD pair will probably retreat and test the 1212/0 level, which was broken yesterday, as a support. If this support where the Tenkan-sen line (nine-period moving average, red line) currently sits on the 4-hour chart fails to hold the market, the pair may head back to the 1205.30 - 1203 area. Below that, the bulls will be waiting at 1195.50 - 1193.54. If the bulls intend to charge, they will have to push prices above the 1221/5 resistance zone. Breaking through this barrier could increase speculative buying pressure and clear the way towards 1235/40.