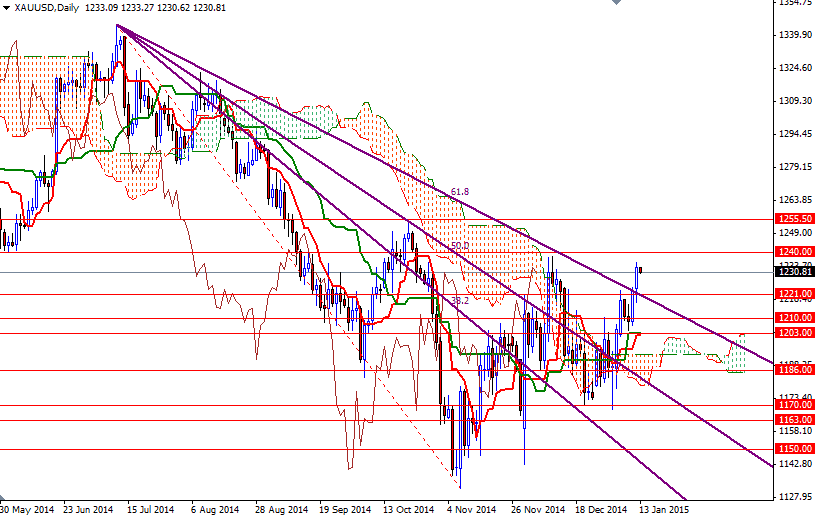

Gold prices rose for a second-straight session to settle at their highest level since November 22 as heightened risk aversion, weaker American dollar and strong physical demand in Asia combined to lift the market. The XAU/USD pair initially retreated during the Asian session yesterday but the market found enough support to reverse and follow the course. As a result, the pair traded as high as $1235.79 an ounce before pulling back to before pulling back to its current location.

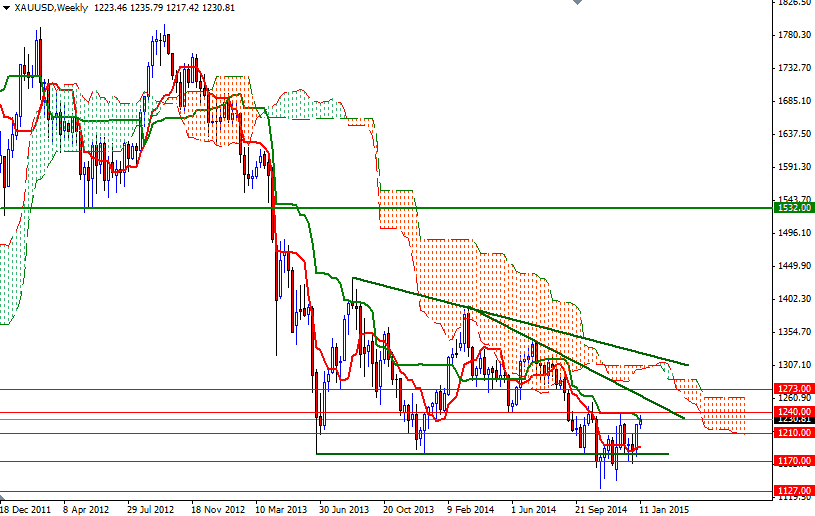

The equity markets are suffering as plunging oil prices continue to weigh on energy shares and that is increasing demand for safe-haven assets. With that in mind, I think the bulls will be taking advantage of this situation and try to push prices higher in the short term. As I pointed out in my previous analysis, the resistance at 1240 which has established itself as an important level several times during the past two years will play a crucial role going forward.

If the market climbs and holds above the 1240 level, then we will probably see a bullish continuation targeting the critical 1252 - 1255.50 resistance zone which might attract some sellers. Once beyond that, there is little to slow down the bulls' progression until 1268 - 1273. However, if the bears increase pressure and manage to defend their fort at 1240, then the market will probably head back to the 1221 level where the Kijun-sen (twenty six-day moving average, green line) resides on the 4-hour chart. A daily close below 1221 would suggest that we might revisit 1217 and 1210.