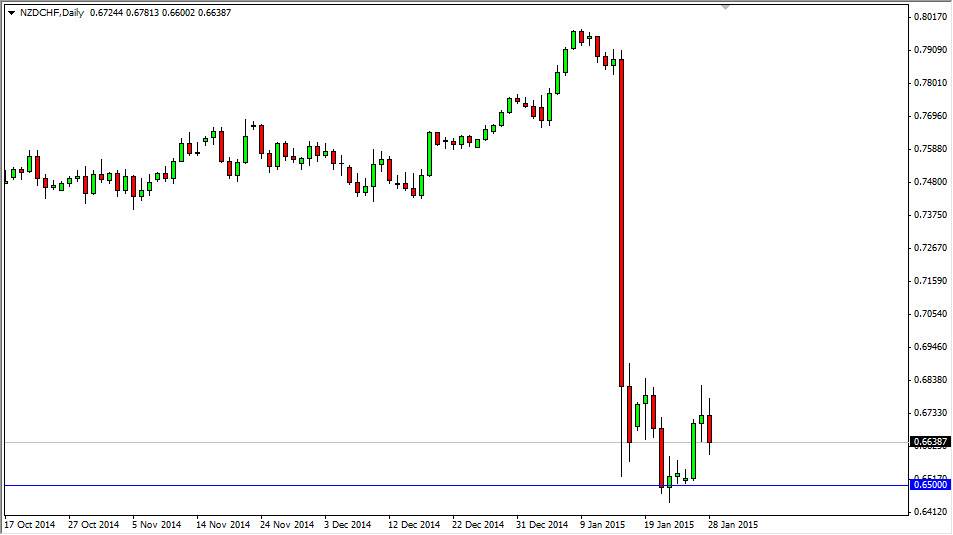

The NZD/CHF pair initially tried to rally during the course of the session on Wednesday, but as you can see turned back around and started to fall. There a lot of different things going on right now, but the Royal Bank of New Zealand stating that it was worried about the economy, and the fact that it could possibly cut rates in the future of course drive down the value of the Kiwi dollar. On the other hand, we have the Swiss National Bank recently removing the currency peg, and that of course has driven a lot of demand for the Swiss franc going forward.

As you can see below, the 0.65 level below is supportive, as that’s where the market stop falling. It looks like we are going to retest that area for support, and quite frankly would not surprise me at all if we continue to see bearish pressure and a break down below there.

The 0.65 level matters

The 0.65 level does matter in my opinion, and I believe that if we can break down below there the market should head to the 0.60 level. Ultimately, the market looks as if it is one that you cannot buy, and you have to sell. With that, I believe that rallies will continue to offer selling opportunities, and as a result I have no interest whatsoever in buying even if we bounce from the 0.65 handle.

There is the slim possibility that we rally from here, and if we do I think that’s a selling opportunity. However, after the remarks by the Row Bank of New Zealand, I find it very difficult to believe, and therefore I would be very surprised by some type of rally. This pair should continue to be soft, as we have one of the strongest currencies in the world matched up against one of the weakest. Ultimately, I still believe that the 0.60 level is targeted over the longer term.