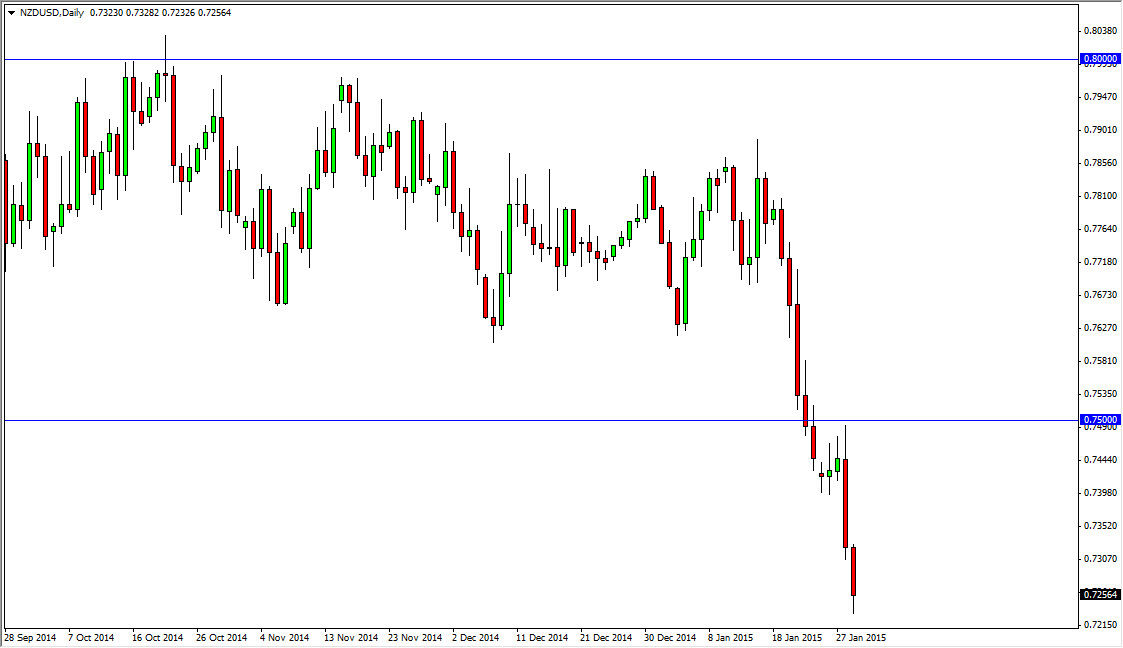

The NZD/USD pair continued falling during the session on Thursday, even after the massive selloff during the Wednesday session. The Royal Bank of New Zealand stated that rate cuts were possible, and at that point in time the New Zealand dollar took a nosedive. Now that we have had yet another day of selling, it is obvious that we are going to continue the downtrend, and there should be no doubt about it at this point.

Looking at the longer-term charts, there is a little bit of support at the 0.7250 level, but quite frankly that is going to cause a bounce that I will be selling. That’s the best case scenario about the support, as quite frankly we could to slice through it as well. Any rally at this point time is going to invite selling as far as I can tell, and I will use resistive candles in order to do so. I still believe that the 0.70 level is where we are going longer-term, and possibly even lower.

Royal Bank of New Zealand wants 0.68

While it may not get that exact figure, the truth is that the Royal Bank of New Zealand suggested recently that “fair value” for this particular currency pair is closer to the 0.68 handle. Because of that, I don’t think it’s a real stretch to imagine this pair going down to the 0.70 handle, which of course lines of nicely with support on the monthly chart. Whether or not we can get to the 0.68 handle might be another question, but the one thing that I do understand is that we are certainly going lower from here. With fallen quite a bit of the last couple of days, so would be nice to see a little bit of a bounce that I could sell, as it essentially represents value in the US dollar.

Keep in mind as well that the commodity markets look very soft, and that certainly does not help the New Zealand dollar either. Is highly leveraged to commodity markets, although it does tend to focus on agricultural markets, but as uses a proxy for general attitude towards futures.