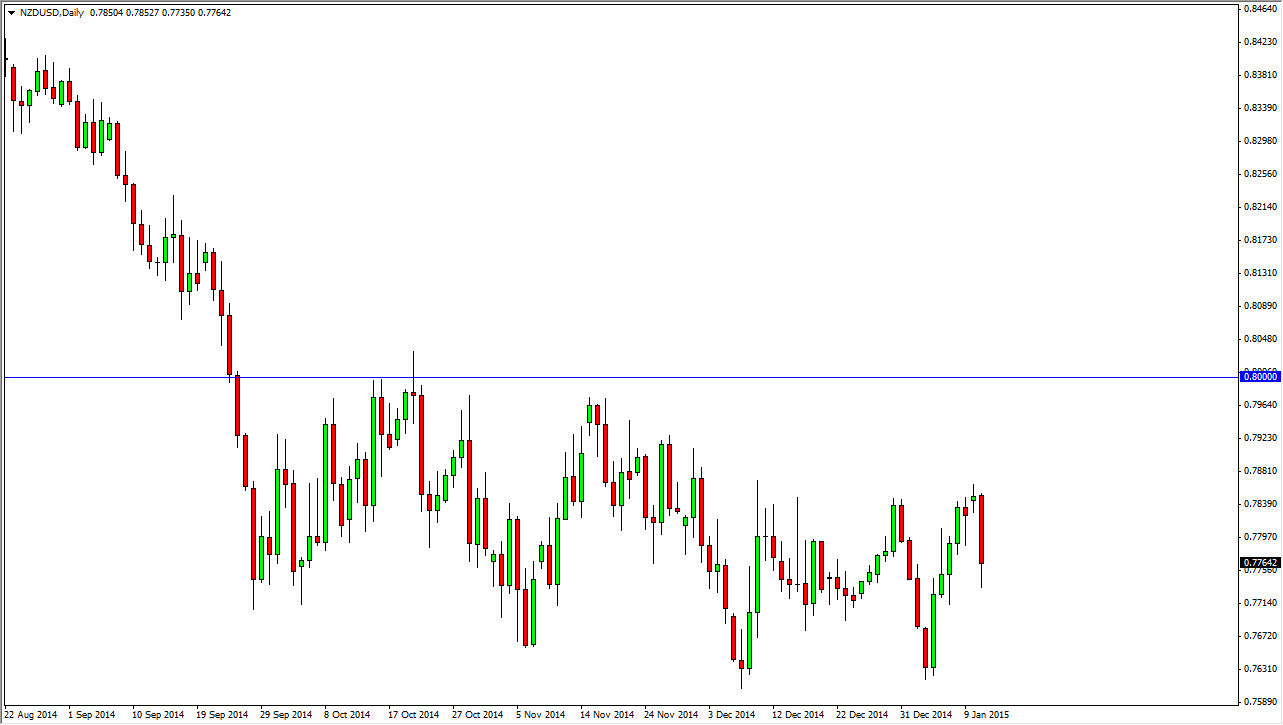

The NZD/USD pair broke down during the session on Monday, testing the 0.7750 level. We did have a little bit of support in this area, keeping this market somewhat afloat. That being the case though, what’s more important is whether or not we can break down below the lows for the session as it would be a return to the bottom of the recent consolidation area. That should send the market down to the 0.7650 region, as the market is most certainly in a very negative trend. Having said that, I don’t think that this market is going to break down anytime soon, and as a result I think that this is a short-term trade.

I also believe that short-term rallies will offer selling opportunities, but you have to keep in mind that this is a market that’s a very volatile just as most Forex pairs are at the moment. The US dollar is without a doubt overbought at this point in time, and with that being the case I feel that although this market certainly should continue lower over the longer term, you may have a bit of bouncing from time to time between now and then.

Royal Bank of New Zealand

The Royal Bank of New Zealand continues to want to see the New Zealand dollar lower, and it’s very likely that they will given enough time. After all, the New Zealand dollar is very sensitive to the commodity markets in general, and those of course are very volatile to say the least. With that, I am not very comfortable buying this pair, even though there might be short-term buying opportunities below. It’s just a matter of selling rallies until of course we make some type of breakout the changes my mind.

That breakout of course would be a move above the 0.80 level, which is something that I don’t see happening anytime soon. In fact, any short-term resistive candle between here and there is going to be a nice selling opportunity as far as I can see.