USD/CHF Signal Update

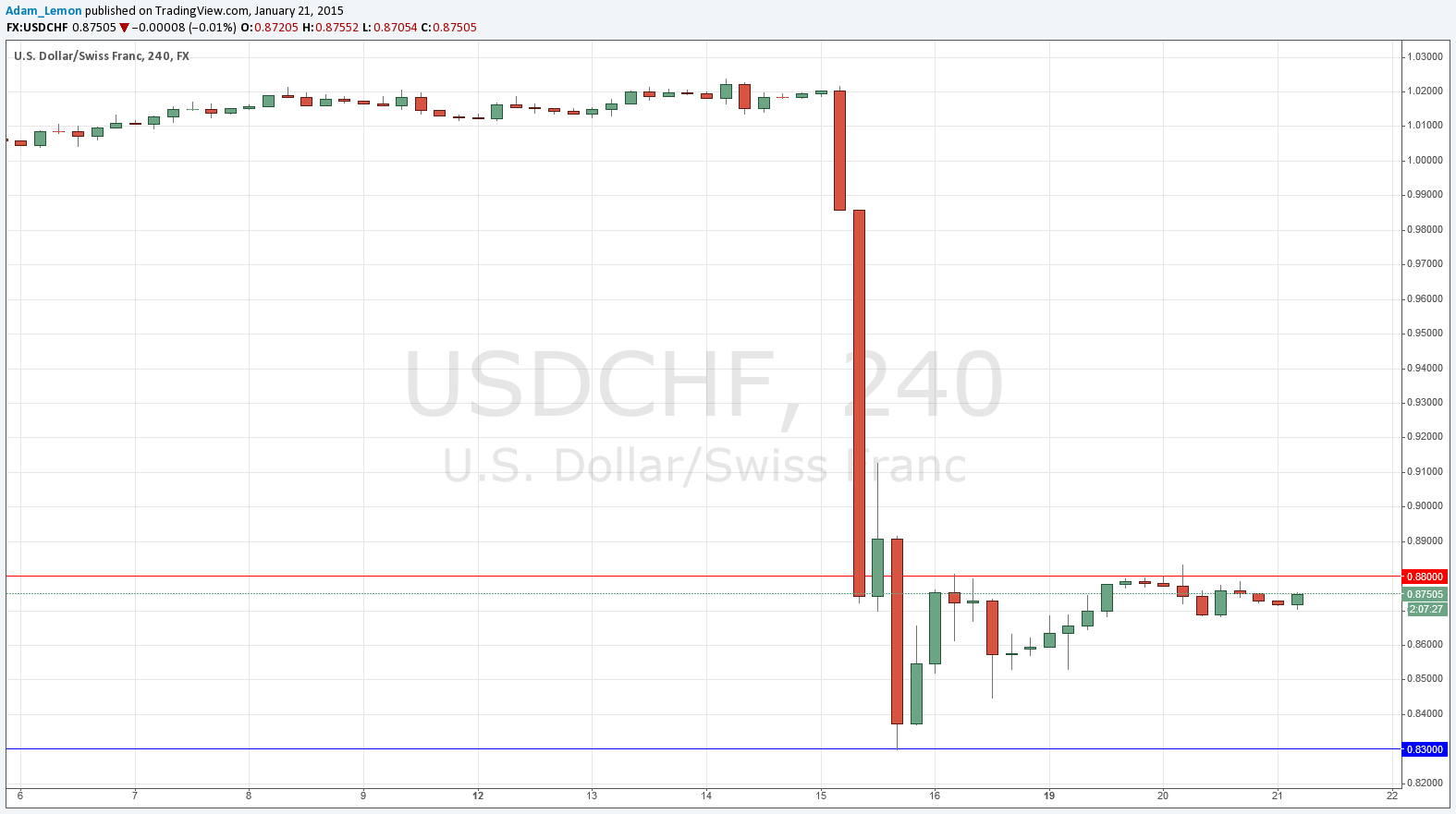

Yesterday’s signal to go short following bearish price action on the H4 time frame was triggered, with the price falling to a little below 0.8700 before coming back to break even to hit the stop loss. However half the position would have been taken off at 40 pips of profit, giving a profitable trade.

Today’s USD/CHF Signals

No signal is given today, as it is too soon to look for another bearish bounce off a return to the 0.8800 level.

USD/CHF Analysis

I wrote yesterday that it was likely that the price was going to find it hard to remain above 0.8800, and if it was below that level one hour after the London Open, to look for a short off bearish price action. We did have that short, but we subsequently had a bounce up off the 0.8700 which may be developing into local support. The volatility is calming down meaning that the CHF is stabilising and we can soon resume more normal position sizing when we trade this pair. Beyond the possible support developing at around the 0.8700 level, it is hard to identify any more important technical developments.

If the price is able to make a sustained break above 0.8800, it is quite likely to hit 0.9000 before falling substantially. As there is so much space on the charts technically, it is quite likely that round, whole numbers are going to play an important role as support and resistance levels.

There are no high-impact data releases scheduled today concerning the CHF. Regarding the USD, there will be a release of Building Permits data at 1:30pm London time. Due to the recent price shock and volatility, it is likely to be a relatively active day for this pair.