USD/JPY Signal Update

Yesterday’s signal was not triggered as there was no suitable bullish price action when the price retested 117.75 earlier during the Tokyo session. There was a bullish inside bar, but it broke down, and the price fell further, penetrating the support.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only between 8am and 5pm New York time, and then after 8am Tokyo time later.

Long Trade 1

• Long entry following bullish price action on the H1 time frame immediately after the price first reaches 116.82.

• Put the stop loss 1 pip below the local swing low.

• Adjust the stop loss to break even once the trade is 25 pips in profit.

• Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

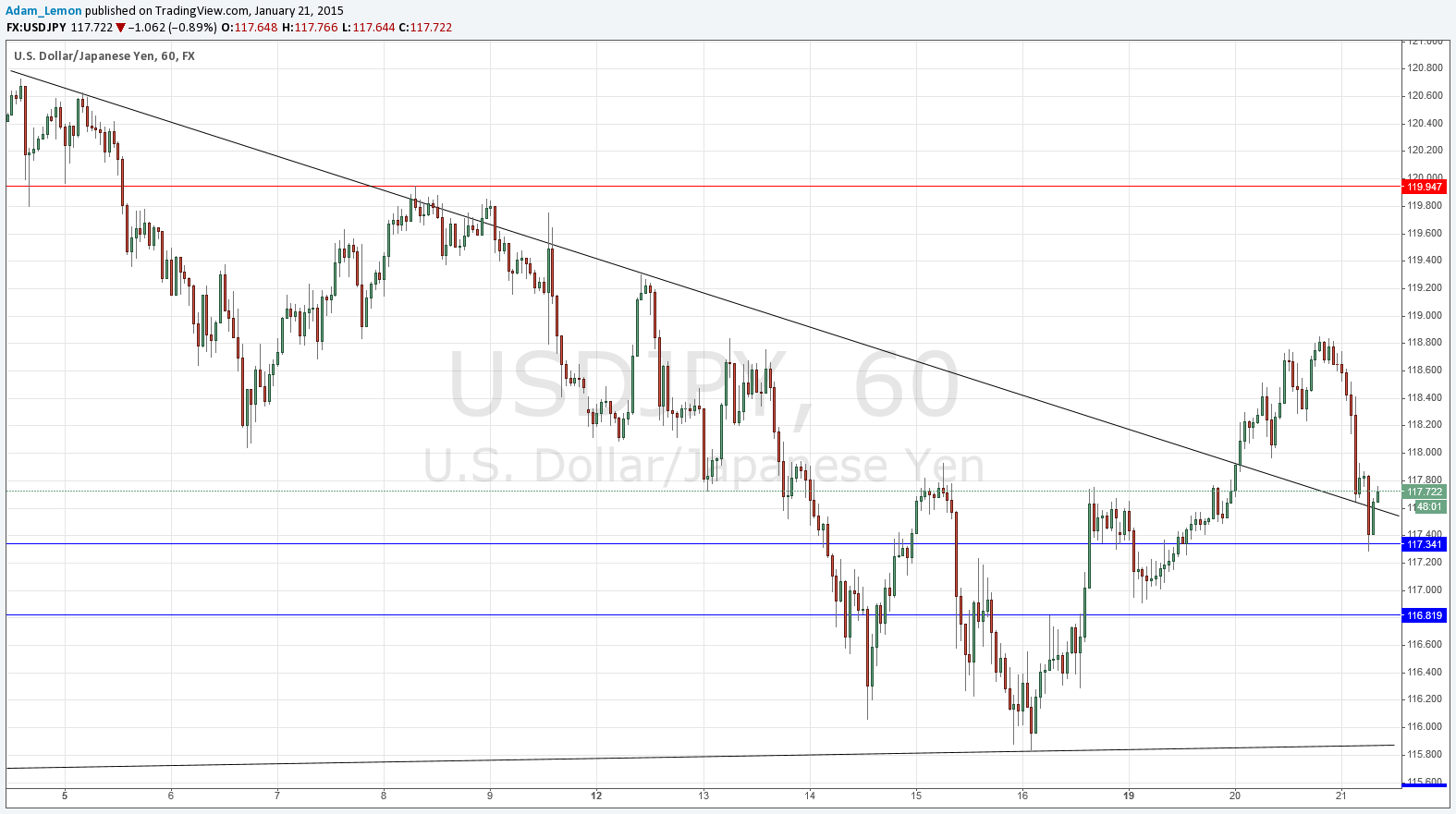

USD/JPY Analysis

I was expecting yesterday that a later return to the 117.75 level, especially when confluent with the broken bearish trend line, would give this pair a re-launch upwards. However the price action did not confirm this: there was initially a small bounce which quickly broke down, and the price fell back below the trend line. This means that the level at 117.75 should be considered too sloshed around to be likely to continue acting as support or resistance, as should the bearish trend line, although it still appears on today’s chart below.

There is local resistance at 118.80, where there is a double top, but I am not looking for a short trade there. Conversely, there is local support at 117.34, but I would not be looking for a long there yet either. Over the next 24 hours, the best opportunity would be if the price were to fall down below 117.00, and bounce up off probably support off 116.82.

There are no high-impact data releases scheduled today concerning the JPY. Regarding the USD, there will be a release of Building Permits data at 1:30pm London time.