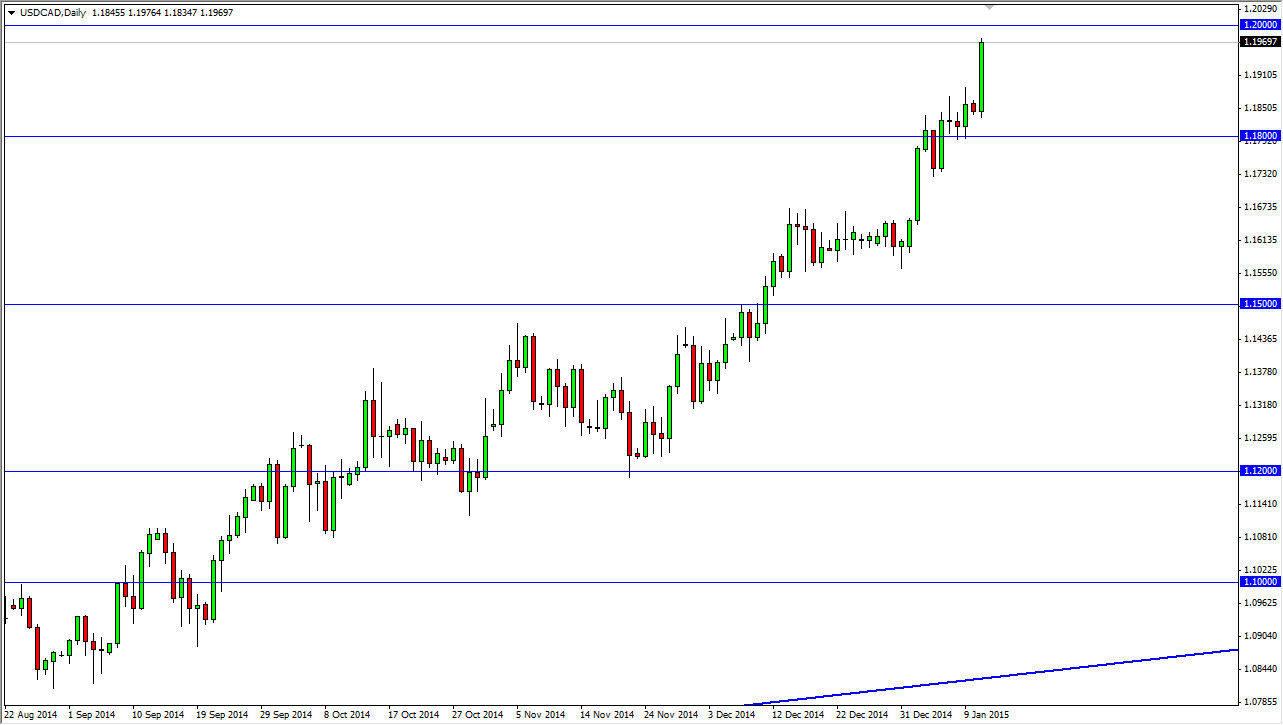

The USD/CAD pair broke out to the upside during the session on Monday, as the oil markets fell apart yet again. With that being the case, the market looks as if it’s ready to continue going higher but we have to deal with the 1.20 level above which of course is a large, round, psychologically significant number. With that, I anticipate that we will more than likely pullback a little bit from this area, but at the end of the day the fact that we have closed at the very top of the candle for the session tells me that we will more than likely try to find support below in order to build up enough momentum to finally break out. Once we get above the 1.20 level, I believe that we will start the next leg higher.

The shape of the candle of course is very bullish, and the fact that the oil markets seem like they can’t find the bottom at the moment certainly doesn’t make me want to own the Canadian dollar the moment. Because of this, I think that we will continue to see bullishness but it is healthy to get a pullback at this point in time as well.

Continued bullishness, but with a pause.

I believe that we will continue to see bullishness, but we will more than likely pause. That being the case, a pullback to the 1.18 level wouldn’t exactly be a huge surprise, and I do believe that there will be a significant amount of support in that general vicinity. Even if we get below there, I believe that the 1.16 level will of course be massively supportive as well, and I think that a pullback will simply be an attempt to build up enough momentum to finally break out above the 1.20 level. That being the case, I have no interest in shorting this market, so I am looking for those supportive candles as potential buying opportunities in a market that is most certainly tilted to the upside going forward.