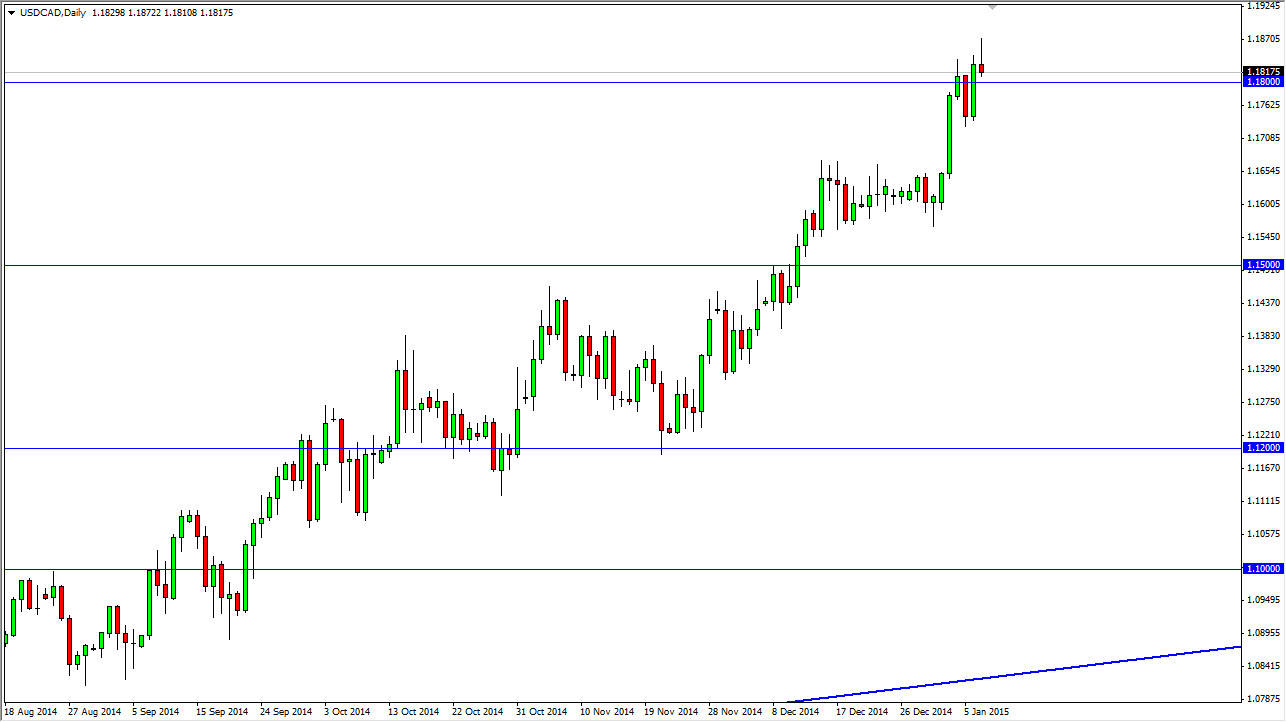

The USD/CAD pair broke higher initially during the session on Wednesday, but pulled back in order to form a shooting star. With that, looks like the market going to simply consolidate in this general vicinity and that makes a lot of sense to me. After all, Friday features the nonfarm payroll numbers, but also features Canadian employment numbers. In other words it’s a bit of a “double whammy” when it comes to this particular pair.

I believe that ultimately this pair does go higher, and I do look at this pullback as a potential buying opportunity. However, I’m going to be very cautious about when I jump into this market, as I can also see it falling down to the 1.16 level without too many issues. I believe that the 1.15 level is essentially the “floor” in this market, so a move below there would have me rethinking a lot to be honest.

Watch the oil markets

Watch the oil markets for potential directionality on the Canadian dollar. After all, they did look a little bit supportive during the session on Wednesday, and if the balance it’s very likely that this market could fall. I don’t think that it’s worth selling, I just think that it shows that the pullback is coming. That’s fine, because you have to look at it as potential value in the US dollar. After all, the US dollar is without a doubt the strongest currency in the Forex world right now. Because of this, I have no interest in selling it, least of all against a commodity currencies such as the Canadian dollar.

All things being equal, I think that we will eventually see the 1.20 level, but it may take the announcements on Friday to give us the extra momentum to break out. If we broke down below the 1.15 handle, at that point in time I would have to rethink the entire situation in this particular market. However, I don’t think that’s what happens and therefore I just look at it as a potential scenario, but not a likely one.