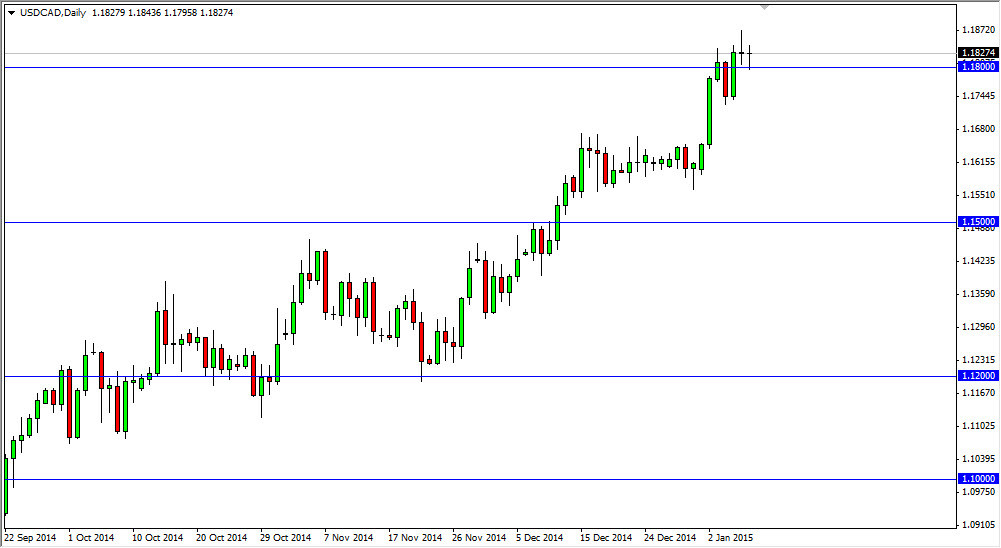

The USD/CAD pair went back and forth during the session on Thursday, as we continue to hover above the 1.18 level. This is an area that has been important for quite some time, and as a result this market is sitting here as we await the employment numbers from both countries today. In fact, this is probably going to be one of those days that determines the next move.

If we can get above the shooting star on Wednesday, I believe that the market will go to the 1.20 level shortly. Pullbacks from time to time will appear, and they will be buying opportunities as far as I can see. With that being the case, I also look at pullbacks from this area down to the 1.15 level as potential buying opportunities as well. After all, the US dollar is without a doubt the strongest currency around the world right now. On top of that, the oil markets don’t exactly look healthy. The Canadian dollar will not get a boost from the oil market in my opinion, even though it could bounce. Any bounce in the oil market would just simply translate into a pullback in this particular currency pair.

This will be a volatile day.

Today will be a bit of a perfect storm as both economies are showing the most important economic announcements. With that, expect a lot of slamming around in this pair, but I think ultimately the trend will stay the same unless of course we have some type of horrific number coming out of the United States. With that, I believe the pullbacks will be gifts that we can take advantage of.

I’m hoping that we get a bit of a pullback, but quite frankly the fact that we formed a hammer on the day before sometimes suggests what the market is getting ready do anyways. With that being the case, I don’t even have the idea of selling, at least not until we get below the 1.15 handle. Regardless, this will more than likely be one of the best trading opportunities today.