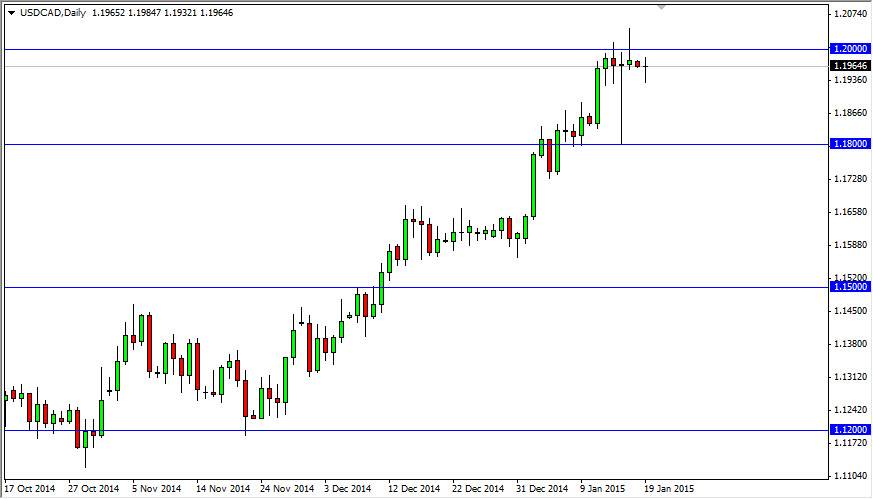

The USD/CAD pair did almost nothing during the session on Monday, as we printed a neutral candle just underneath the 1.20 resistance barrier. This isn’t a huge surprise though, as most of the volume in this pair tends to happen during North American trading hours. With Monday been Martin Luther King Junior Day in the United States, most of that volume wasn’t even present. The Europeans typically don’t trade this pair in large volume, so expecting a move during Monday’s trading session was probably asking a bit much.

I see the 1.20 level above as resistive, just as I see the 1.18 level below as supportive. We could continue to consolidate in this general vicinity, but I think ultimately we will break out to the upside. The oil markets are not helping the Canadian dollar right now, and even though they are starting to stagnate a little bit, signs of strength just aren’t there. In other words, Forex traders will be buying the Canadian dollar as a proxy for oil quite yet.

Impulsive candles needed

An impulsive candle is needed in this market as far as I can see, in order to break out or at least give us an opportunity to get involved. I don’t think that the market is quite ready to break out though, and a pullback would make a lot of sense right now. The 1.20 level is a massive large round number, and a fairly significant level on the longer-term charts as well. Normally these areas take several attempts to break above or below, and I don’t anticipate this potential break out to be any different. Ultimately, I think that the market probably goes to the 1.25 level or the next several months, but this pair does tend to grind a sideways for long periods of time. With that, I am waiting to see either the pullback that shows support near the 1.18 level, or a large impulsive candle to the upside in order to start buying again. In the meantime, all you can do is be patient and wait.