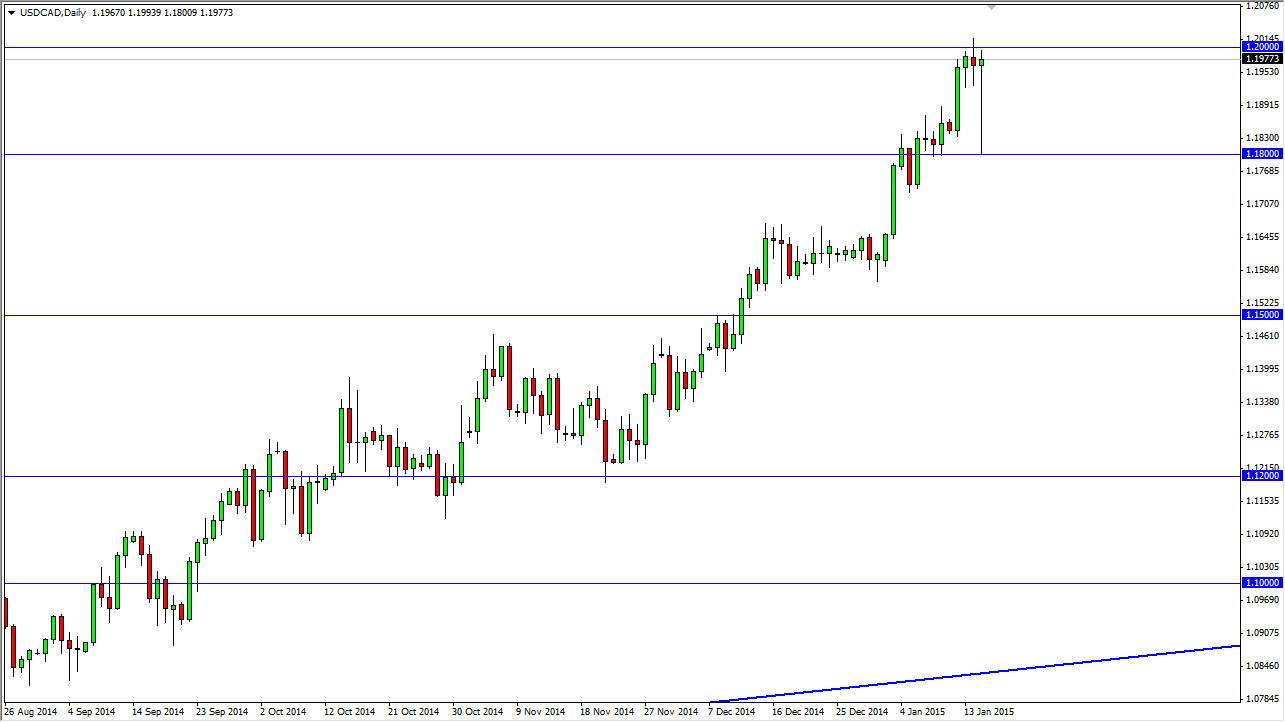

The USD/CAD pair fell rather significantly during the session on Thursday, but found the 1.18 level to be just as supportive as I had anticipated. In fact, it was supportive enough that we bounced all the way back up to the 1.1975 region. Now that we have done that, we have formed a wicked looking hammer, and it seems all but a formality before we break above the 1.20 handle. That being the case, I am in fact buyers above the most recent high from the Wednesday session, and believe that this market will probably then head to the 1.22 handle. Most certainly, the 1.18 level has shown itself to be massively supportive.

On top of this, the oil markets seem like they can’t find the bottom. We did up forming a shooting stars in the Light Sweet Crude and the Brent markets, which of course will have a knock on effect in this pair. Ultimately, this market should continue until higher because quite frankly the oil markets look so soft, and the US dollar of course looks so strong. The continue the uptrend should be relatively reliable, but keep in mind that this pair does tend to be a bit choppy from time to time.

Wicked hammer

I believe that this wicked hammer is a sign that this pair is ready to go higher, and the top of that I have seen very similar candles against the CAD and several other currency pairs as well. In other words, as the oil markets fall apart, the Canadian dollar is receiving no love. That being the case, we should continue to see the Canadian dollar fall in general, as well as other oil-based currencies.

With that being the case, I don’t see any reason why you would want to sell the US dollar for an oil-based economy and its currency. I don’t think that the Canadian economy itself is falling apart, just that this is a rebalance of strength in North America that has long been overdue. After all, the Americans are producing their own fuel these days.