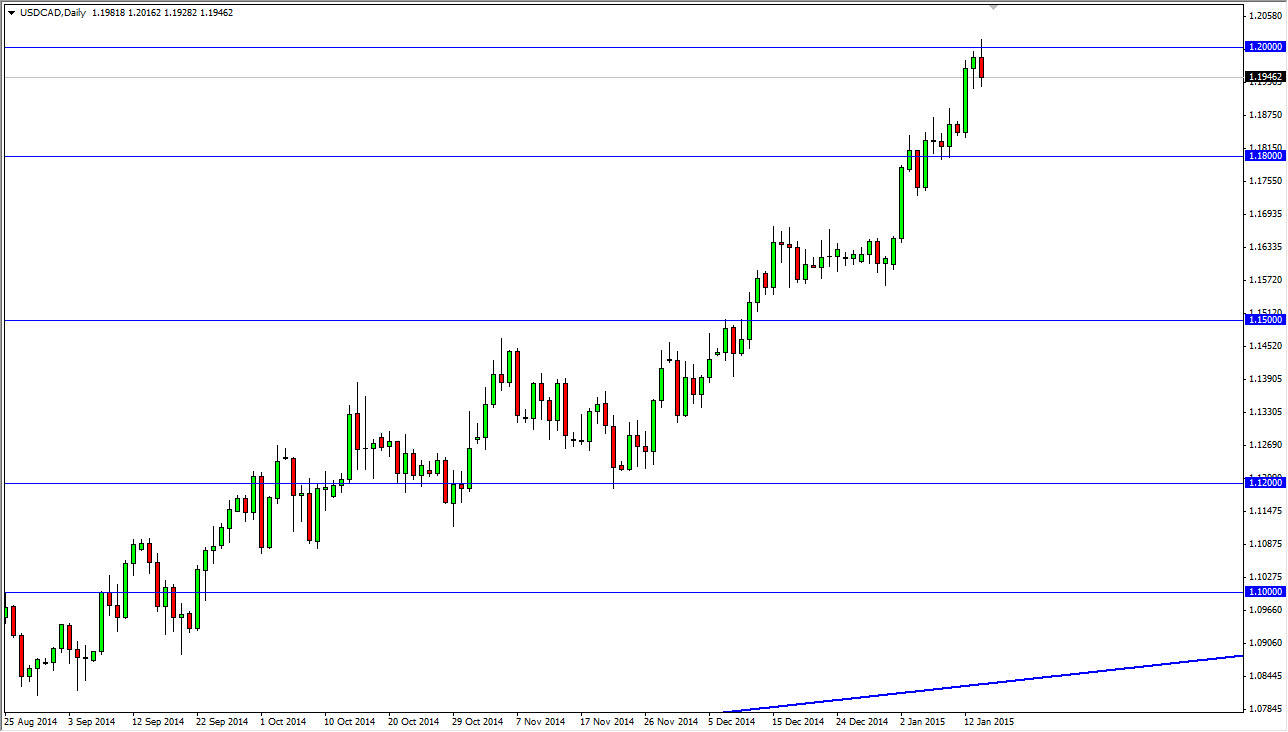

The USD/CAD pair tried to break above the 1.20 level during the session on Wednesday, but as you can see was repelled and ended up forming a fairly negative candle. It’s not really a big surprise though, because of course the 1.20 level is a large, round, psychologically significant number, and that’s it is also a known resistance barrier. My suspicion is that this is more or less going to be profit taking than anything else, so any pullback at this point in time gets me interested in going long yet again. I believe that the 1.18 level will be supportive, and therefore I am not willing to sell this pair, but would rather wait and start buying supportive candles.

On the other hand, we could break out above the top of the candle from the Wednesday session, and that of course would be a very bullish sign. I would prefer to see the pullback though, simply because it offers value in the US dollar. This pair is a little bit ahead of itself, so the pullback should be thought of as being very healthy for the buyers.

Oil markets aren’t helping

As far as the Canadian dollar is concerned, oil markets certainly aren’t being very helpful at this point in time. Because of this, the Canadian dollar is being punished, and so is the Norwegian krone for that matter, and pretty much anything else attached to the petroleum markets. Remember, the Forex traders out there will trade oil by proxy using the Canadian dollar as one of their favorite tools.

That being the case, I don’t really see an argument for this pair to break down with any significant. Yes, we are bit overbought but that’s not the move that you want to sell, that’s the move that you want to wait on instantly take advantage of the value that appears towards the end of it. With that being said, I would love to see a supportive candle closer to the 1.18 level in order to go long again, but of course would have to take the breakout above the top of the candle as a sign that we are going to continue this impulsive move.