USD/CHF Signal Update

There are no outstanding signals.

Today’s USD/CHF Signals

No signals are given today.

USD/CHF Analysis

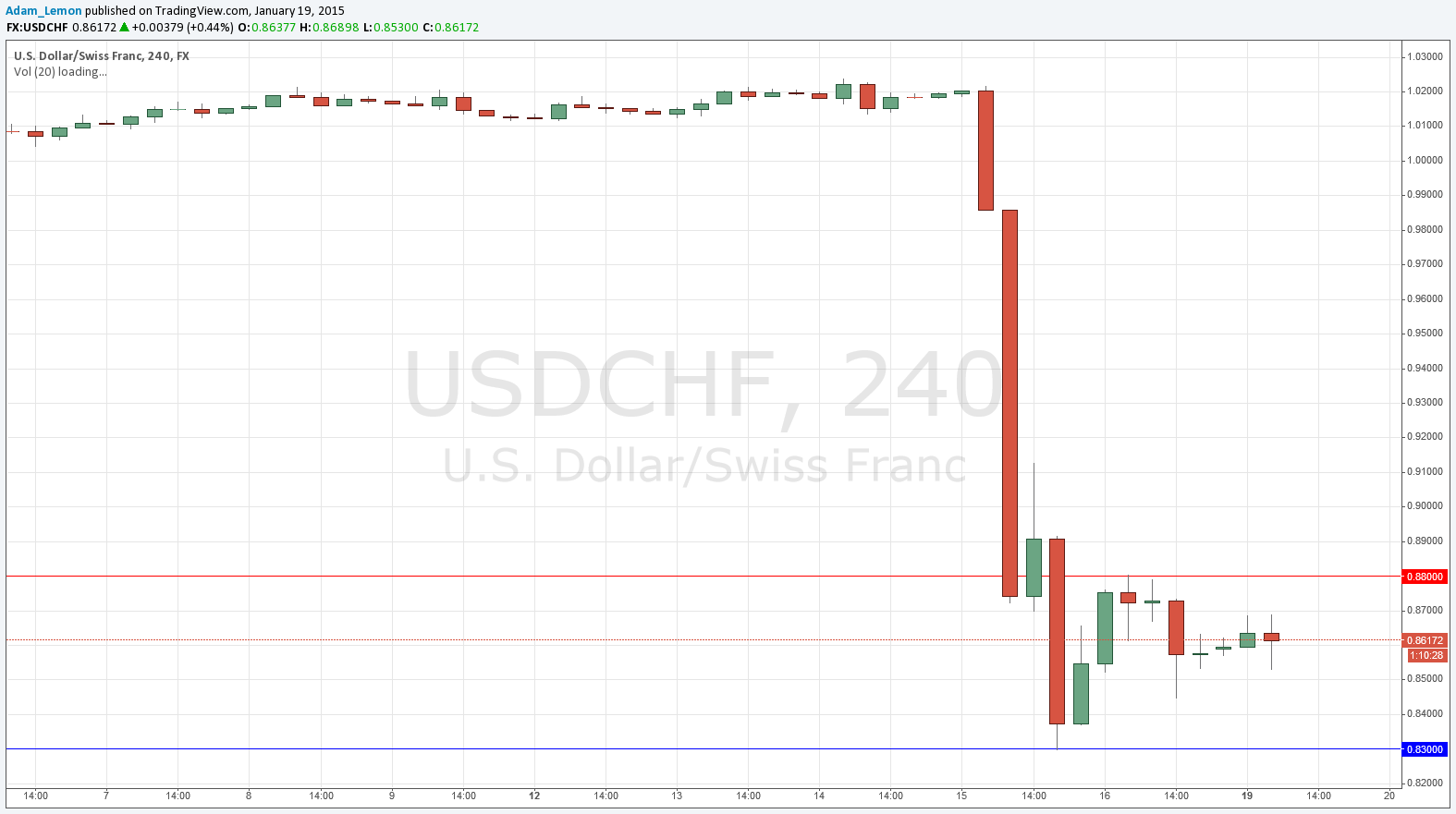

The pair fell very strongly on Thursday and Friday after a sharp pull back on Wednesday that drove the price up above 1.1800. At one point late last week the price even got well below 1.1500, before rising with a fairly strong bounce. It would seem logical that 1.1500 would be fairly supportive, but due to the high volatility and turbulence unleashed by the uncapping of the CHF by the Swiss National Bank last Thursday, it is hard to see supportive levels holding with any precision. There is no real obvious probably support before the area at around 1.10, and it is widely expected that this pair has further to fall.

Due to the strong downwards trend and bias, and the absence of obvious support, it makes sense to look for short opportunities at previously flipped level. The first such level that we have above us is a nice round number at 1.1650. Above that, there is 1.1860.

There are no high-impact data releases scheduled today concerning either the CHF or the USD. It is a public holiday in the USA. However, due to the recent price shock and continuing high volatility, it is likely to be a relatively active and volatile day for this pair.