USD/CHF Signal Update

There are no outstanding signals.

Today’s USD/CHF Signals

Risk 0.15%

Trades may be entered only before 5pm London time.

Short Trade 1

Go short after bearish price action on the H4 time frame provided there is no hourly close above 0.8800.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 40 pips in profit.

Take off 50% of the position as profit when the trade is 40 pips in profit and leave the remainder of the position to ride.

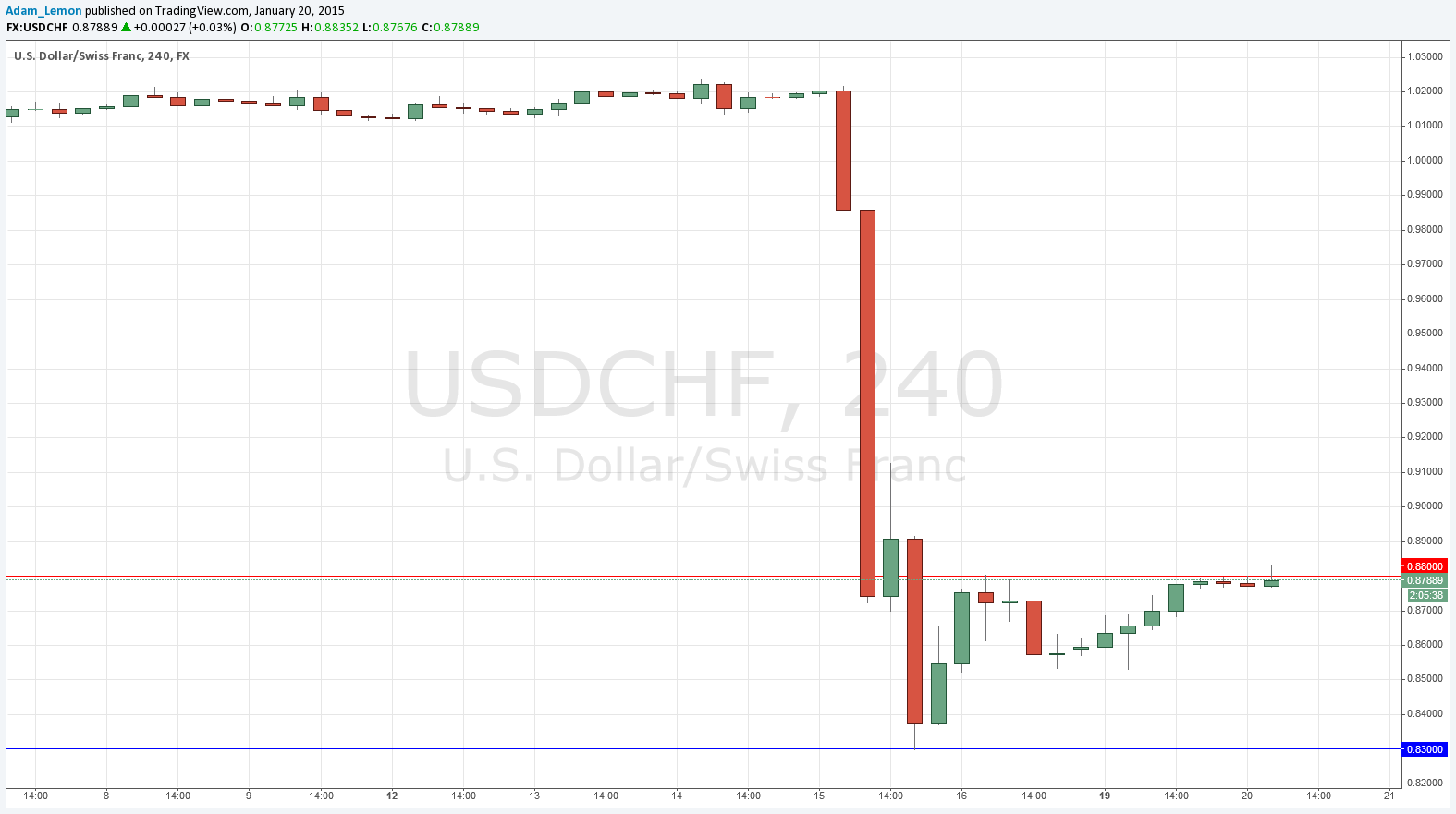

USD/CHF Analysis

The volatility in the CHF has continued to tail off as expected, therefore it looks safe enough to trade now albeit with greatly reduced risk – position sizing should be VERY SMALL.

I wrote yesterday that I was expecting a pull back against the strong upwards move to likely continue, this move did in fact continue yesterday. However this morning as London opens the price is bumping up against the 0.8800 level which I had identified yesterday as possible resistance, so a short trading opportunity may present itself here, provided that the price now turns down sharply. It is showing some signs of doing so, at the time of writing.

If instead the price is above 0.8800 at 9am London time, it will be quite likely to rise further today, but I would not be looking for any other trades just yet.

There are no high-impact data releases scheduled today concerning either the CHF or the USD. However, due to the recent price shock and continuing high volatility, it is likely to be a relatively active and volatile day for this pair.