USD/CHF Signal Update

No signal was given last Thursday.

Today’s USD/CHF Signals

No signal is given today.

USD/CHF Analysis

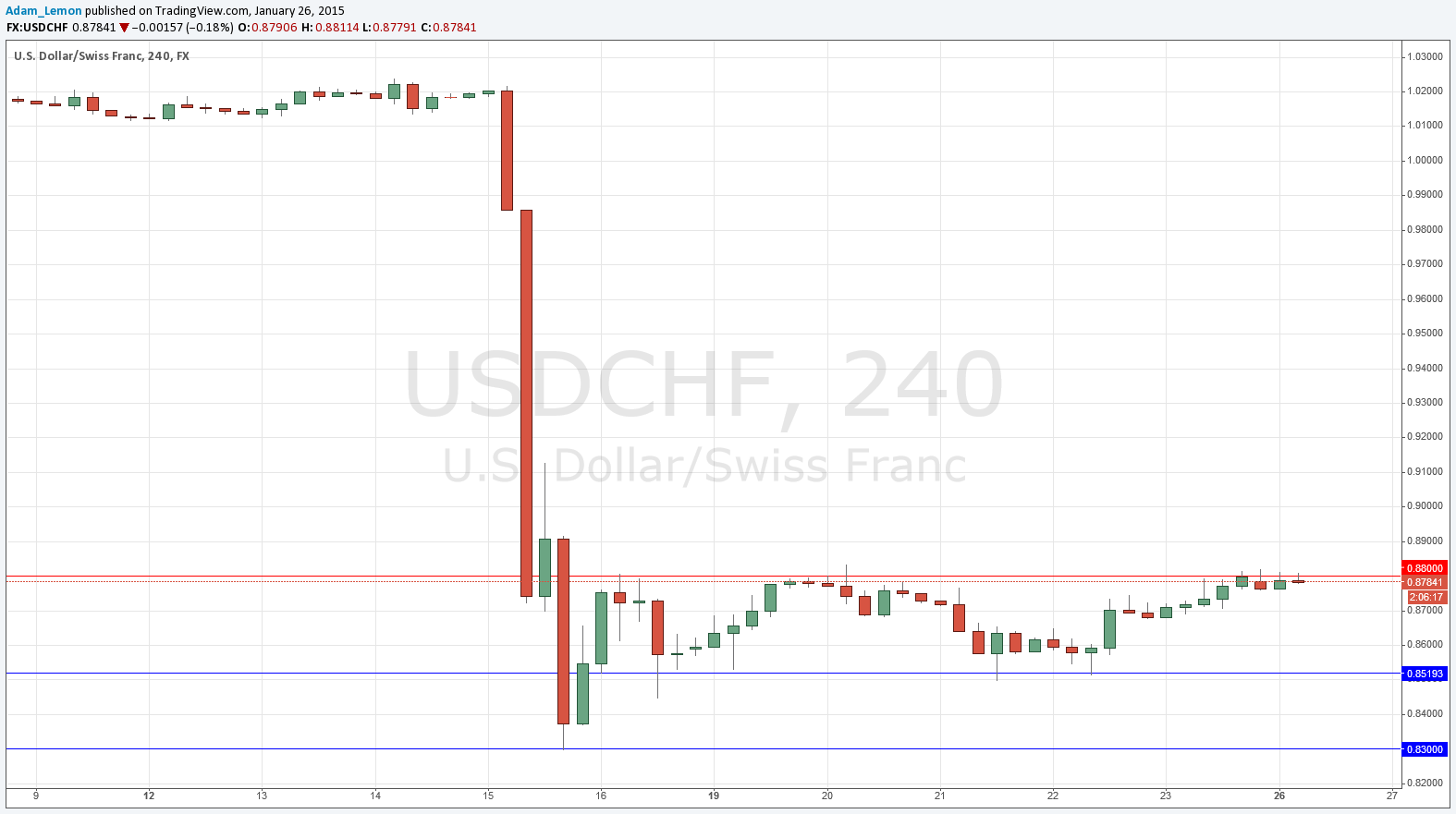

The resistance confluent with the whole round number at 0.8800 has been holding for a while, and is currently undergoing its second major retest. The USD ended last week on a strong note, rising quite sharply against the CAD, USD, and antipodean currencies. With the price now bubbling just under 0.8800, we may actually get a breakout above that level which would logically take that price to the whole round number of 0.8900 at least. At the moment of writing, it does not appear there is much momentum in either direction, which is why I am not looking for a short trade here again. The fact it is the second retest and that this retest is taking a while also suggests a move up from a breakout rather than a move down. This is not a signal, but a long breakout play is possible should the price really move beyond 0.8800.

It is hard to say where resistance might be above 0.8800 except for the logical points of 0.8900 and especially 0.9000.

The CHF is in uncharted waters in some respects. We do not really have a clear idea how much it is going to be moving in line with the Euro, or Gold. There is less reason for it to move with the Euro now the SNB peg has been removed. The CHF is logically strong, but if it does not start going up over the next few weeks, that strength will have to be questioned.

There are no high-impact data releases scheduled today directly concerning the USD or the CHF; therefore it may be a relatively quiet day for this pair.