USD/CHF Signal Update

There are no outstanding signals.

Today’s USD/CHF Signals

Risk 0.50% per trade.

Trades must be entered before 5pm London time and moved to break even by 6:30pm London time.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9130.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 50 pips in profit.

Take off 50% of the position as profit when the trade is 50 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 0.8800.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 50 pips in profit.

Take off 50% of the position as profit when the trade is 50 pips in profit and leave the remainder of the position to ride.

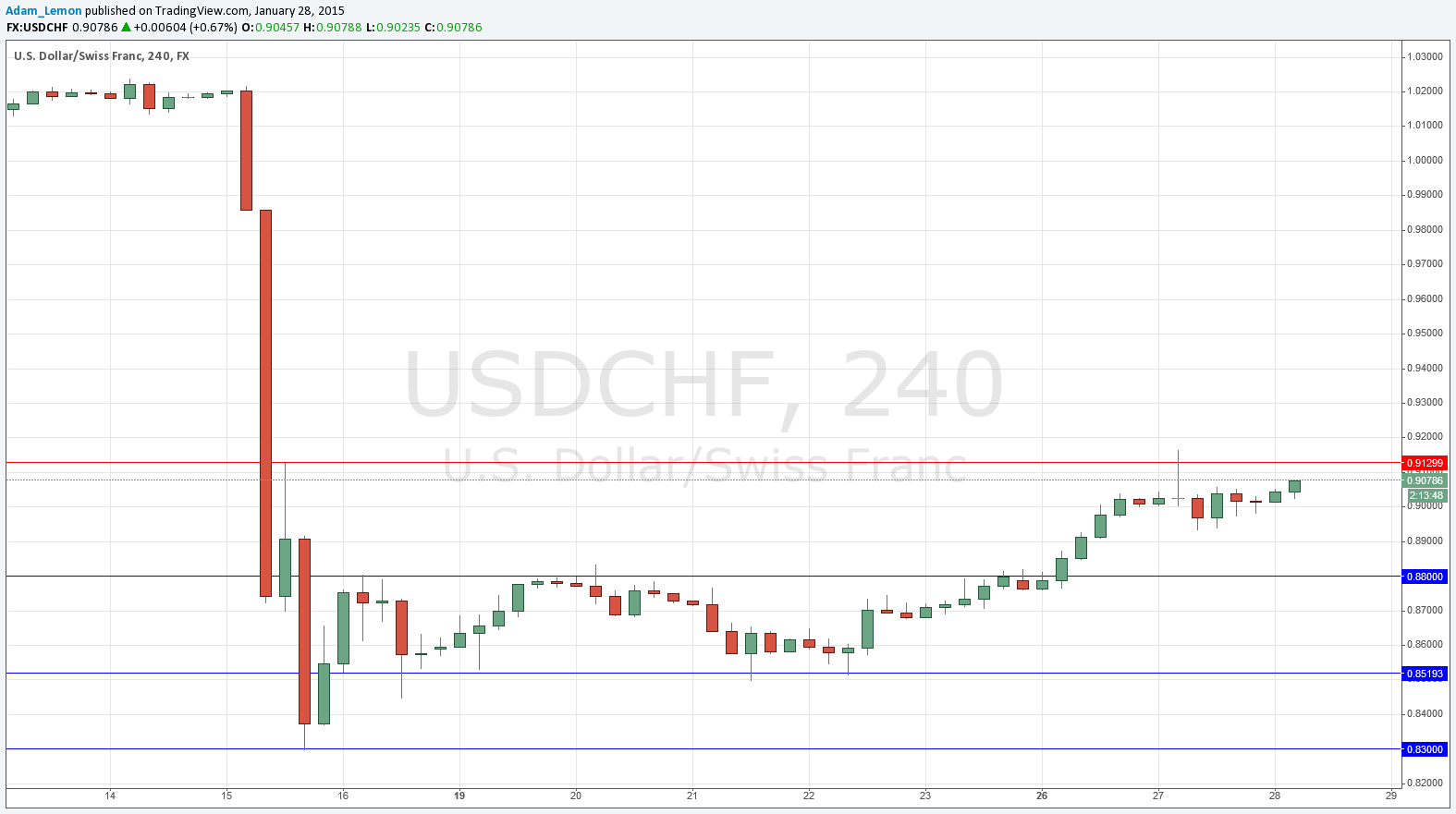

USD/CHF Analysis

I wrote yesterday that the 0.9130 level might prove to be resistant and this was in fact the case. The price did pop above it, but retreated very quickly.

There is a fairly strong and solid movement against the CHF, but there is still great volatility in play, so should the CHF begin to strengthen again it could easily move a great distance.

If 0.9130 holds, it can be traded for a short reversal with extreme caution.

There is a big USD event after the London session tonight, so in the unlikely event of any trades being entered off these levels today, be sure to take the risk off the trade before the news release.

There are no high-impact data releases scheduled today concerning the CHF, but there are regarding the USD later after London closes. At 7pm London time there will be a release of the FOMC Statement and Federal Funds Rate. This might have a big impact upon the USD.