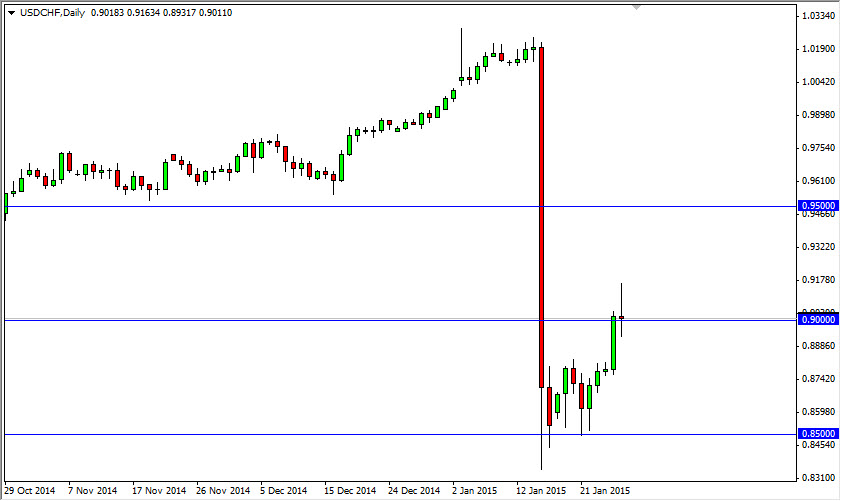

The USD/CHF pair initially went higher during the course of the session on Tuesday, but as you can see turned back around to form a shooting star. What I find truly interesting is that we formed a shooting star right at the 0.90 handle, and that of course is a very negative sign. I believe that the Swiss franc will continue to strengthen overall, so it makes complete sense that if we break the bottom of the range for the session that we should continue to sell.

The shape this candle is just about perfect, and as a result I am very confident in this move. On top of that, the 0.90 level is a perfect large number, and it makes sense that the sellers would step back into the market at this area. If we can break the bottom of the scandal, I don’t see any reason why we don’t go back down to the 0.85 handle given enough time.

US dollar strength

There is US dollar strength out there, so I think this will probably be one of the more stable markets to trade. While the Swiss franc should strengthen overall, the truth of the matter is that the US dollar is a fairly strong currency at this time. Because of this, that could take a bit of the volatility out of this market as it should drift lower. Be aware the fact that there is a significant amount of volatility in almost anything relating to the Swiss franc right now, and the Euro of course. In other words, it’s easier to avoid half of the volatility when you stick with the US dollar.

Even if we broke the top of the shooting star, I do not think that you can buy this market. I believe that if you continue to go higher more than likely the 0.95 level above should be massively resistive. That is another area where I would love to sell on a resistant candle as well. Ultimately, I think the 0.85 level will be tested yet again.