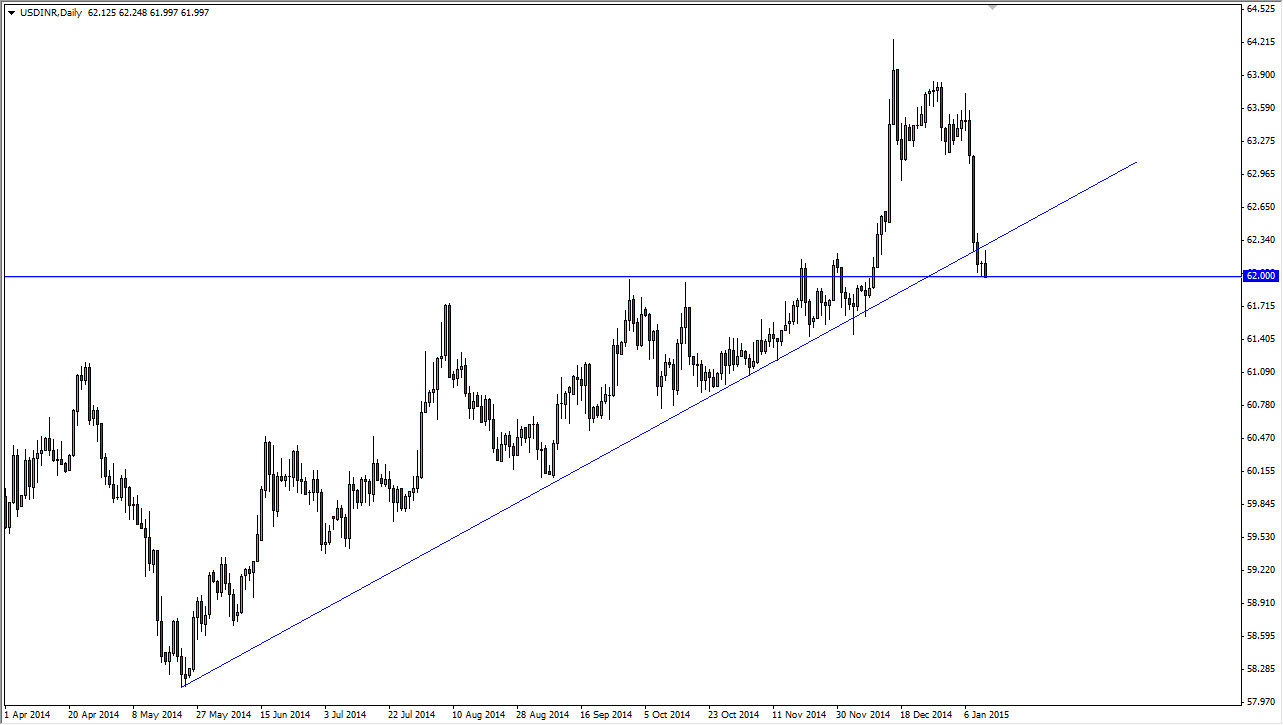

The USD/INR pair has been extraordinarily positive for some time now, but we have recently broken down below a fairly significant trend line as far as I can see. On top of that, during the Monday session we even tested the bottom of the trend line and failed. As I write this article at the end of the day, we are testing the 62 level. The 62 level for me is significant support, and if we can break below there we could see a bit of a trend change. The US dollar has been overbought for some time now, and this could be a move that sells off rather drastically.

One of the great things is that this trend line has been so obvious, so I believe that most of the world is probably paying attention to it. The fact that we are now below and of course signals weakness, but we haven’t necessarily broken down significantly enough for me to get overly excited. You have to keep in mind that this is a play on the developing world, and perhaps money is trying to shift away from the US dollar as without a doubt it is overbought in general.

Expect volatility nonetheless

You can expect volatility nonetheless, and as a result this is a market that should continue to be one that bounces around significantly. Nonetheless, I believe that if we do close below the 62 handle on the daily chart, we could very well see the beginning of a trend change. We will more than likely head to 61 first, and then possibly 60 after that.

On the other hand if we break above the trend line again, I believe that this market should go much higher if that happens. If that happens, I feel that this is a significant test of the support, and that the trend should continue. However, it certainly looks as if the sellers are starting to step in and perhaps may quite a bit of noise in this marketplace. The next day or two should be rather important.