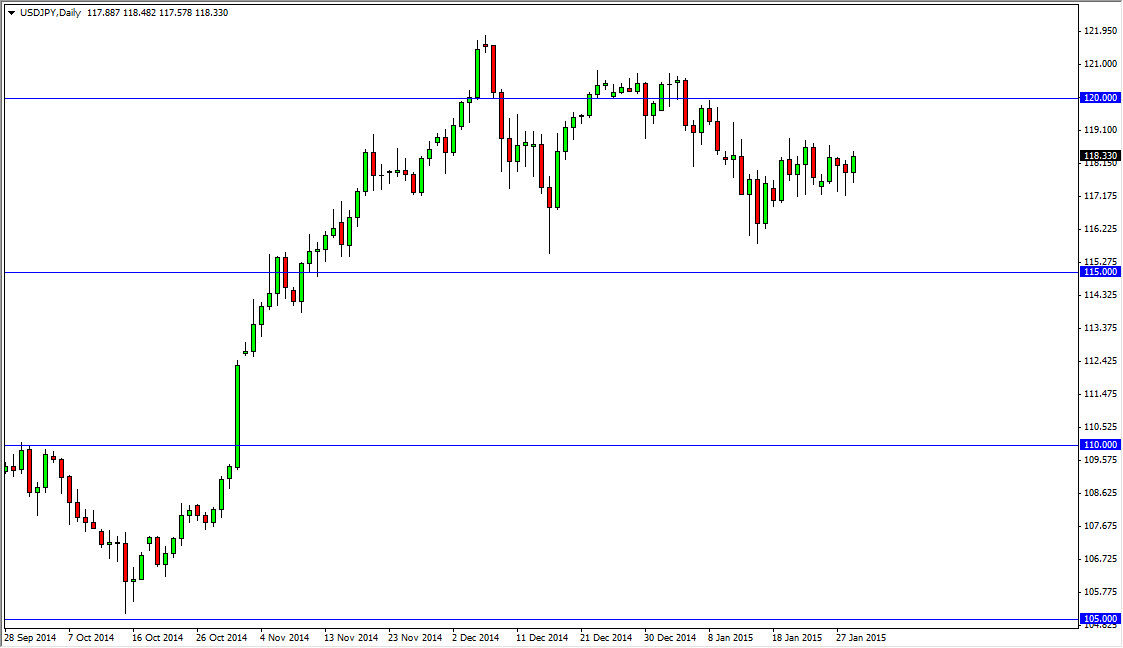

The USD/JPY pair which had previously been so bullish continues to consolidate as the 118 level seems to be a bit of a magnet at this point in time. The Thursday session didn’t give as much to act upon, and at this point time I am simply paying attention to this market, but not necessarily putting any money into it. Granted, I still believe that we go higher but at this point in time it looks very stagnant, and a bit aloof.

I believe that the 115 level below is supportive, just as I believe the 120 level above is resistive. I do think that more than likely we will break out to the upside, and finally clear above the 120 handle. If and when we do that, the next target will be 122, and then 125. I don’t think that’s going to be an easy move, but I do believe ultimately over the longer term we do go higher.

Bank of Japan

The Bank of Japan continues to try and the value the Yen, and I don’t see that changing anytime soon. They are bound and determined to get Japan out of recessionary conditions, and in that particular economy they need a cheap currency in order to boost exports. Because of this, I believe that the Bank of Japan will essentially do anything it needs to in order to bring down the value of the Yen, which means we should see even more quantitative easing.

On the other side the Pacific, you have the Federal Reserve and the fact that it has stepped out of the quantitative easing game certainly will not have been lost on most traders. That means the interest-rate should eventually rise in favor of the US dollar, but at this moment in time the bond markets look like they are telling a slightly different story. Because of this, the USD/JPY pair may go sideways for a while. Sooner or later the bond market traders and Forex traders come to an agreement, but at this point in time they are divergent still, making this a difficult pair to trade.