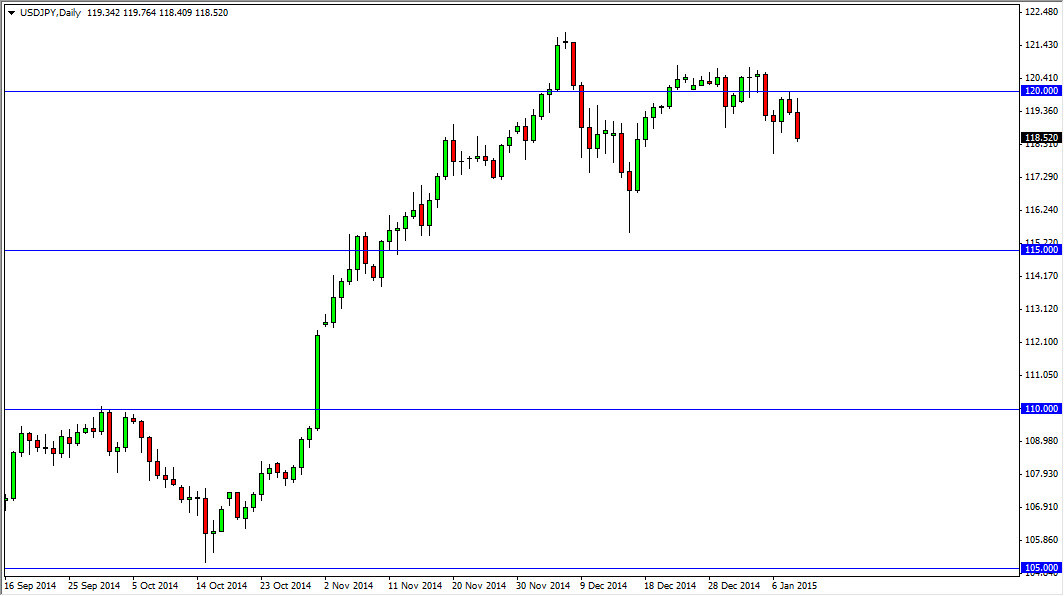

The USD/JPY pair initially tried to rally during the course of the day on Friday, but found enough resistance at the 120 level to turn things back around and start falling. Ultimately, the market ended up forming a relatively negative candle, but at the end of the day I have no interest whatsoever in selling this market. There are simply far too many areas where the buyers could step back into push the US dollar higher, and as a result anytime this market falls, I am simply waiting to see whether or not a get a nice supportive candle in order to start buying. They tend to think of it as a US dollar been “on sale.”

Ultimately, I believe that the 115 level below is essentially the “floor”, but I also recognize that there is quite a bit of support near the 170 level as well, so really think downside is limited at best. I think that as we pulled back and form supportive candles, it’s essentially going to be a buying opportunity for market that is most certainly bullish.

No selling plans whatsoever

I have no plans whatsoever to sell this pair, as it is far too bullish of the longer-term. I think that any time it pulls back it will be a buying opportunity, and quite frankly even if the 115 level gets broken to the downside, I probably would still be a bit hesitant to sell.

The Bank of Japan will do everything it can to devalue the Yen, as it always has. The real question is whether or not the Federal Reserve is going to raise rates anytime and 2015. We don’t know really yet, but I have the sneaking suspicion that the market may be a little bit ahead of itself. In other words, a nice pullback wouldn’t exactly hurt anything and would only allow us to build up enough momentum to break out above the 120 level for good. At that point time, I would anticipate testing the 125 handle.